Research Topics & Ideas: Finance

PS – This is just the start…

We know it’s exciting to run through a list of research topics, but please keep in mind that this list is just a starting point . To develop a suitable education-related research topic, you’ll need to identify a clear and convincing research gap , and a viable plan of action to fill that gap.

Overview: Finance Research Topics

- Corporate finance topics

- Investment banking topics

- Private equity & VC

- Asset management

- Hedge funds

- Financial planning & advisory

- Quantitative finance

- Treasury management

- Financial technology (FinTech)

- Commercial banking

- International finance

Corporate Finance

These research topic ideas explore a breadth of issues ranging from the examination of capital structure to the exploration of financial strategies in mergers and acquisitions.

- Evaluating the impact of capital structure on firm performance across different industries

- Assessing the effectiveness of financial management practices in emerging markets

- A comparative analysis of the cost of capital and financial structure in multinational corporations across different regulatory environments

- Examining how integrating sustainability and CSR initiatives affect a corporation’s financial performance and brand reputation

- Analysing how rigorous financial analysis informs strategic decisions and contributes to corporate growth

- Examining the relationship between corporate governance structures and financial performance

- A comparative analysis of financing strategies among mergers and acquisitions

- Evaluating the importance of financial transparency and its impact on investor relations and trust

- Investigating the role of financial flexibility in strategic investment decisions during economic downturns

- Investigating how different dividend policies affect shareholder value and the firm’s financial performance

Investment Banking

The list below presents a series of research topics exploring the multifaceted dimensions of investment banking, with a particular focus on its evolution following the 2008 financial crisis.

- Analysing the evolution and impact of regulatory frameworks in investment banking post-2008 financial crisis

- Investigating the challenges and opportunities associated with cross-border M&As facilitated by investment banks.

- Evaluating the role of investment banks in facilitating mergers and acquisitions in emerging markets

- Analysing the transformation brought about by digital technologies in the delivery of investment banking services and its effects on efficiency and client satisfaction.

- Evaluating the role of investment banks in promoting sustainable finance and the integration of Environmental, Social, and Governance (ESG) criteria in investment decisions.

- Assessing the impact of technology on the efficiency and effectiveness of investment banking services

- Examining the effectiveness of investment banks in pricing and marketing IPOs, and the subsequent performance of these IPOs in the stock market.

- A comparative analysis of different risk management strategies employed by investment banks

- Examining the relationship between investment banking fees and corporate performance

- A comparative analysis of competitive strategies employed by leading investment banks and their impact on market share and profitability

Private Equity & Venture Capital (VC)

These research topic ideas are centred on venture capital and private equity investments, with a focus on their impact on technological startups, emerging technologies, and broader economic ecosystems.

- Investigating the determinants of successful venture capital investments in tech startups

- Analysing the trends and outcomes of venture capital funding in emerging technologies such as artificial intelligence, blockchain, or clean energy

- Assessing the performance and return on investment of different exit strategies employed by venture capital firms

- Assessing the impact of private equity investments on the financial performance of SMEs

- Analysing the role of venture capital in fostering innovation and entrepreneurship

- Evaluating the exit strategies of private equity firms: A comparative analysis

- Exploring the ethical considerations in private equity and venture capital financing

- Investigating how private equity ownership influences operational efficiency and overall business performance

- Evaluating the effectiveness of corporate governance structures in companies backed by private equity investments

- Examining how the regulatory environment in different regions affects the operations, investments and performance of private equity and venture capital firms

Need a helping hand?

Asset Management

This list includes a range of research topic ideas focused on asset management, probing into the effectiveness of various strategies, the integration of technology, and the alignment with ethical principles among other key dimensions.

- Analysing the effectiveness of different asset allocation strategies in diverse economic environments

- Analysing the methodologies and effectiveness of performance attribution in asset management firms

- Assessing the impact of environmental, social, and governance (ESG) criteria on fund performance

- Examining the role of robo-advisors in modern asset management

- Evaluating how advancements in technology are reshaping portfolio management strategies within asset management firms

- Evaluating the performance persistence of mutual funds and hedge funds

- Investigating the long-term performance of portfolios managed with ethical or socially responsible investing principles

- Investigating the behavioural biases in individual and institutional investment decisions

- Examining the asset allocation strategies employed by pension funds and their impact on long-term fund performance

- Assessing the operational efficiency of asset management firms and its correlation with fund performance

Hedge Funds

Here we explore research topics related to hedge fund operations and strategies, including their implications on corporate governance, financial market stability, and regulatory compliance among other critical facets.

- Assessing the impact of hedge fund activism on corporate governance and financial performance

- Analysing the effectiveness and implications of market-neutral strategies employed by hedge funds

- Investigating how different fee structures impact the performance and investor attraction to hedge funds

- Evaluating the contribution of hedge funds to financial market liquidity and the implications for market stability

- Analysing the risk-return profile of hedge fund strategies during financial crises

- Evaluating the influence of regulatory changes on hedge fund operations and performance

- Examining the level of transparency and disclosure practices in the hedge fund industry and its impact on investor trust and regulatory compliance

- Assessing the contribution of hedge funds to systemic risk in financial markets, and the effectiveness of regulatory measures in mitigating such risks

- Examining the role of hedge funds in financial market stability

- Investigating the determinants of hedge fund success: A comparative analysis

Financial Planning and Advisory

This list explores various research topic ideas related to financial planning, focusing on the effects of financial literacy, the adoption of digital tools, taxation policies, and the role of financial advisors.

- Evaluating the impact of financial literacy on individual financial planning effectiveness

- Analysing how different taxation policies influence financial planning strategies among individuals and businesses

- Evaluating the effectiveness and user adoption of digital tools in modern financial planning practices

- Investigating the adequacy of long-term financial planning strategies in ensuring retirement security

- Assessing the role of financial education in shaping financial planning behaviour among different demographic groups

- Examining the impact of psychological biases on financial planning and decision-making, and strategies to mitigate these biases

- Assessing the behavioural factors influencing financial planning decisions

- Examining the role of financial advisors in managing retirement savings

- A comparative analysis of traditional versus robo-advisory in financial planning

- Investigating the ethics of financial advisory practices

The following list delves into research topics within the insurance sector, touching on the technological transformations, regulatory shifts, and evolving consumer behaviours among other pivotal aspects.

- Analysing the impact of technology adoption on insurance pricing and risk management

- Analysing the influence of Insurtech innovations on the competitive dynamics and consumer choices in insurance markets

- Investigating the factors affecting consumer behaviour in insurance product selection and the role of digital channels in influencing decisions

- Assessing the effect of regulatory changes on insurance product offerings

- Examining the determinants of insurance penetration in emerging markets

- Evaluating the operational efficiency of claims management processes in insurance companies and its impact on customer satisfaction

- Examining the evolution and effectiveness of risk assessment models used in insurance underwriting and their impact on pricing and coverage

- Evaluating the role of insurance in financial stability and economic development

- Investigating the impact of climate change on insurance models and products

- Exploring the challenges and opportunities in underwriting cyber insurance in the face of evolving cyber threats and regulations

Quantitative Finance

These topic ideas span the development of asset pricing models, evaluation of machine learning algorithms, and the exploration of ethical implications among other pivotal areas.

- Developing and testing new quantitative models for asset pricing

- Analysing the effectiveness and limitations of machine learning algorithms in predicting financial market movements

- Assessing the effectiveness of various risk management techniques in quantitative finance

- Evaluating the advancements in portfolio optimisation techniques and their impact on risk-adjusted returns

- Evaluating the impact of high-frequency trading on market efficiency and stability

- Investigating the influence of algorithmic trading strategies on market efficiency and liquidity

- Examining the risk parity approach in asset allocation and its effectiveness in different market conditions

- Examining the application of machine learning and artificial intelligence in quantitative financial analysis

- Investigating the ethical implications of quantitative financial innovations

- Assessing the profitability and market impact of statistical arbitrage strategies considering different market microstructures

Treasury Management

The following topic ideas explore treasury management, focusing on modernisation through technological advancements, the impact on firm liquidity, and the intertwined relationship with corporate governance among other crucial areas.

- Analysing the impact of treasury management practices on firm liquidity and profitability

- Analysing the role of automation in enhancing operational efficiency and strategic decision-making in treasury management

- Evaluating the effectiveness of various cash management strategies in multinational corporations

- Investigating the potential of blockchain technology in streamlining treasury operations and enhancing transparency

- Examining the role of treasury management in mitigating financial risks

- Evaluating the accuracy and effectiveness of various cash flow forecasting techniques employed in treasury management

- Assessing the impact of technological advancements on treasury management operations

- Examining the effectiveness of different foreign exchange risk management strategies employed by treasury managers in multinational corporations

- Assessing the impact of regulatory compliance requirements on the operational and strategic aspects of treasury management

- Investigating the relationship between treasury management and corporate governance

Financial Technology (FinTech)

The following research topic ideas explore the transformative potential of blockchain, the rise of open banking, and the burgeoning landscape of peer-to-peer lending among other focal areas.

- Evaluating the impact of blockchain technology on financial services

- Investigating the implications of open banking on consumer data privacy and financial services competition

- Assessing the role of FinTech in financial inclusion in emerging markets

- Analysing the role of peer-to-peer lending platforms in promoting financial inclusion and their impact on traditional banking systems

- Examining the cybersecurity challenges faced by FinTech firms and the regulatory measures to ensure data protection and financial stability

- Examining the regulatory challenges and opportunities in the FinTech ecosystem

- Assessing the impact of artificial intelligence on the delivery of financial services, customer experience, and operational efficiency within FinTech firms

- Analysing the adoption and impact of cryptocurrencies on traditional financial systems

- Investigating the determinants of success for FinTech startups

Commercial Banking

These topic ideas span commercial banking, encompassing digital transformation, support for small and medium-sized enterprises (SMEs), and the evolving regulatory and competitive landscape among other key themes.

- Assessing the impact of digital transformation on commercial banking services and competitiveness

- Analysing the impact of digital transformation on customer experience and operational efficiency in commercial banking

- Evaluating the role of commercial banks in supporting small and medium-sized enterprises (SMEs)

- Investigating the effectiveness of credit risk management practices and their impact on bank profitability and financial stability

- Examining the relationship between commercial banking practices and financial stability

- Evaluating the implications of open banking frameworks on the competitive landscape and service innovation in commercial banking

- Assessing how regulatory changes affect lending practices and risk appetite of commercial banks

- Examining how commercial banks are adapting their strategies in response to competition from FinTech firms and changing consumer preferences

- Analysing the impact of regulatory compliance on commercial banking operations

- Investigating the determinants of customer satisfaction and loyalty in commercial banking

International Finance

The folowing research topic ideas are centred around international finance and global economic dynamics, delving into aspects like exchange rate fluctuations, international financial regulations, and the role of international financial institutions among other pivotal areas.

- Analysing the determinants of exchange rate fluctuations and their impact on international trade

- Analysing the influence of global trade agreements on international financial flows and foreign direct investments

- Evaluating the effectiveness of international portfolio diversification strategies in mitigating risks and enhancing returns

- Evaluating the role of international financial institutions in global financial stability

- Investigating the role and implications of offshore financial centres on international financial stability and regulatory harmonisation

- Examining the impact of global financial crises on emerging market economies

- Examining the challenges and regulatory frameworks associated with cross-border banking operations

- Assessing the effectiveness of international financial regulations

- Investigating the challenges and opportunities of cross-border mergers and acquisitions

Choosing A Research Topic

These finance-related research topic ideas are starting points to guide your thinking. They are intentionally very broad and open-ended. By engaging with the currently literature in your field of interest, you’ll be able to narrow down your focus to a specific research gap .

When choosing a topic , you’ll need to take into account its originality, relevance, feasibility, and the resources you have at your disposal. Make sure to align your interest and expertise in the subject with your university program’s specific requirements. Always consult your academic advisor to ensure that your chosen topic not only meets the academic criteria but also provides a valuable contribution to the field.

Find The Perfect Research Topic

How To Choose A Research Topic: 5 Key Criteria

How To Choose A Research Topic Step-By-Step Tutorial With Examples + Free Topic...

Research Topics & Ideas: Automation & Robotics

Research Topics & Ideas: Robotics 50 Topic Ideas To Kickstart Your Research...

Research Topics & Ideas: Sociology

Research Topics & Ideas: Sociology 50 Topic Ideas To Kickstart Your Research...

Research Topics & Ideas: Public Health & Epidemiology

Research Topics & Ideas: Public Health 50 Topic Ideas To Kickstart Your Research...

Research Topics & Ideas: Neuroscience

Research Topics & Ideas: Neuroscience 50 Topic Ideas To Kickstart Your Research...

📄 FREE TEMPLATES

Research Topic Ideation

Proposal Writing

Literature Review

Methodology & Analysis

Academic Writing

Referencing & Citing

Apps, Tools & Tricks

The Grad Coach Podcast

thank you for suggest those topic, I want to ask you about the subjects related to the fintech, can i measure it and how?

Please guide me on selecting research titles

I am doing financial engineering. , can you please help me choose a dissertation topic?

I’m studying Banking and finance (MBA) please guide me on to choose a good research topic.

I am studying finance (MBA) please guide me to choose a good research topic.

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Submit Comment

- Print Friendly

- Have any questions?

- +91-9176966446

- [email protected]

- PhD Topic Selection

- Problem Identification

- Research Proposal

- Pilot Study

- PhD. Dissertation (Full)

- Ph.D. Dissertation (Part)

- Phd-Consultation

- PhD Coursework Abstract Writing Help

- Interim-Report

- Synopsis Preparation

- Power Point

- References Collection

- Conceptual Framework

- Theoretical Framework

- Annotated Bibliography

- Theorem Development

- Gap Identification

- Research Design

- Sample Size

- Power Calculation

- Qualitative Methodology

- Quantitative Methodology

- Primary Data Collection

- Secondary Data Collection

- Quantitative Statistics

- Textual / Content Analysis

- Biostatistics

- Econometrics

- Big Data Analytics

- Software Programming

- Computer Programming

- Translation

- Transcription

- Plagiarism Correction

- Formatting & Referencing

- Manuscript Rewriting

- Manuscript Copyediting

- Manuscript Peer Reviewing

- Manuscript Statistics

- PhD Manuscript Formatting Referencing

- Manuscript Plagiarism Correction

- Manuscript Editorial Comment Help

- Conference & Seminar Paper

- Writing for a journal

- Academic Statistics

- Journal Manuscript Writing

- Research Methodology

- PhD Animation Services

- Academic Law Writing

- Business & Management

- Engineering & Technology

- Arts & Humanities

- Economics & Finance Academic

- Biological & Life Science

- Medicine & Healthcare

- Computer Science & Information

- HIRE A RESEARCH ASSISTANT

Research topics for finance 2023

Research topics for finance 2023.

Finance is the study of money management. The economy runs the world, and financial decisions are made on a daily basis. Currency, loans, bonds, shares, and stocks are all banked, invested, and insured. From small start-ups to large multinational corporations (MNCs), everyone needs finance expertise for insurance and tax reporting. Emerging technologies are constantly changing the way people interact with money, and financial institutions gain from block chain, artificial intelligence and machine learning, cloud banking, and robotic process automation (RPA).

Are you prepared to be on the cutting edge of knowledge? With the help of our innovative platform, Latest research Topics, stay informed and involved. We keep you abreast of developments in today's quick-paced world by bringing you the most recent Ph.D. Topics examples on a variety of domains

As finance & economics is the most in-demand subject, choosing a topic for in-depth research might be difficult. PhD Assistance may assist you in selecting a topic in finance from a broad array of application industries and study latest technology that financial sector use.

- A topic modelling approach to machine learning in finance

- Dynamic topic networks to evaluate systemic risk in financial markets

- Power dynamics in infrastructure public-private partnerships financing

- A systematic review of Fintech developments and ramifications in Islamic Finance

- A study on Risk evaluation of blockchain-powered supply chain financing research

- Impact of privatization on of banks efficiency and profitability: Role of privatisation.

- Stock prices, and cash supply cycle.

- Creating self-employment and financial independence: Contrasting micro-finance banks, micro-finance institutions and their rural support campaigns.

- CAPM validation in guessing stock values in Bombay stock exchange.

- Using the evidence from the sugar industry and related industries to know stock returns and other basic variables.

- Sales price, debt equity, book, and organization size—which of these are an apt barometer of stock exchange returns.

- Mutual funds, their attributes, their performance in the UK.

- What are the optimal debt and equity ratio in various funds?

- Stock returns on capital market investments.

- Relation between return on investment and price-earning ratio.

- A study on price-earnings ratio to guess future growth patterns.

- How dividend pay-out ratio is impacted by the factor’s effect?

- Price-earnings ratio and growth—what’s the relation?

- Studying the relation between dividends and company’s earning in wheat processing industry in the UK.

- Mutual fund’s performance indicators and size of funds.

- Automobile sector in the UK and how the capital structure is determined.

- What factors contribute to a decision on mutual fund investment?

- Forecasting stock price through a model of dividend discount. A study on building industry.

- How macroeconomic variables impact stock sector of UK.

- Mutual fund performance assessment.

- Studying the stock returns by comparing sales price, debt-equity, and book market value.

- Investment spending in the building industry and cash flow. What is the relationship?

- Studying price-earnings ratio in calculating growth

- Impact of free cash flow in a firm’s investment.

- Long-haul performance of IPO’s in the UK. An empirical analysis

- Investment policy and financial leverage.

- Future developments in financial reinforcement learning Techniques

- Structure of the board of directors and the composition’s impact on an organization’s performance.

- How taxation affects an organization’s dividend payout ratio?

- Islamic (Ijara contract) financing and its client satisfaction percentage.

- How mergers and acquisitions affect the firm’s performance in the building sector?

- Causes of changes in price to earnings ratio.

- Share price fluctuations and reasons for fluctuations.

- Stock price, economic variables such as interest rate, inflation, and GDP.

- How profitability is impacted by capital structure.

- How a banks’ profitability is affected by interest rate changes.

- The rate of inflation and stock market returns. Is there a connection?

- Stock price volatility versus Dividend policy.

- Pharma sector and what determines the capital structure.

- Stock’s returns and how it is affected by leverage?

- Factors that forecast mutual fund’s performance in the UK.

- Results of various traits that lead to acquisitions and mergers in the UK.

- Factors impacting leverage in concrete sector industry in the UK.

- How the bank’s profitability is affected by liquidity?

- Free cash flows and investment in the textile sector in the UK. Is there a connection?

- How working capital impacts a firm’s revenue and profits? Study of UK concrete sector.

- Is there a connection between capital structure and corporate strategy?

- Judging the profitability factors of Islamic banking in UAE.

- Does turnover affect inflation?

- Is the investment decision affected by dividend?

- Study of assets and liabilities in balance sheets of various firms.

- The fiscal policy’s impact on the economy of India.

- Bond market capitalization in Australia. What are the factors?

- CPI and bond price. Is there a connection?

- A literature review on Future Applications of financial instruments 2023

In conclusion, know the statistical techniques and data collection methods before deciding upon a topic.

Also, to get assistance on dissertation topics in education, interior design thesis topics, physiotherapy research topics, dissertation topics in microbiology, IIM dissertation topics, sociology dissertation topics, political science dissertation topics, dissertation topics in pediatrics, and also for Research topics in English literature for Phd, avail our Ph.D topic selection support service today !

Need help with your Dissertation Service?

Take a look at topic selection service:

Click Here!

Quick Contact

Dissertation.

Our Dissertation Writing service can help with everything from full dissertations to individual chapters.

Literature Review

Referencing Tools

- Harvard Referencing Tool

- Vancouver Referencing Tool

- APA Referencing Tool

- Privacy Overview

- Strictly Necessary Cookies

- 3rd Party Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

This website uses Google Analytics to collect anonymous information such as the number of visitors to the site, and the most popular pages.

Keeping this cookie enabled helps us to improve our website.

Please enable Strictly Necessary Cookies first so that we can save your preferences!

About Stanford GSB

- The Leadership

- Dean’s Updates

- School News & History

- Commencement

- Business, Government & Society

- Centers & Institutes

- Center for Entrepreneurial Studies

- Center for Social Innovation

- Stanford Seed

About the Experience

- Learning at Stanford GSB

- Experiential Learning

- Guest Speakers

- Entrepreneurship

- Social Innovation

- Communication

- Life at Stanford GSB

- Collaborative Environment

- Activities & Organizations

- Student Services

- Housing Options

- International Students

Full-Time Degree Programs

- Why Stanford MBA

- Academic Experience

- Financial Aid

- Why Stanford MSx

- Research Fellows Program

- See All Programs

Non-Degree & Certificate Programs

- Executive Education

- Stanford Executive Program

- Programs for Organizations

- The Difference

- Online Programs

- Stanford LEAD

- Seed Transformation Program

- Aspire Program

- Seed Spark Program

- Faculty Profiles

- Academic Areas

- Awards & Honors

- Conferences

Faculty Research

- Publications

- Working Papers

- Case Studies

Research Hub

- Research Labs & Initiatives

- Business Library

- Data, Analytics & Research Computing

- Behavioral Lab

Research Labs

- Cities, Housing & Society Lab

- Golub Capital Social Impact Lab

Research Initiatives

- Corporate Governance Research Initiative

- Corporations and Society Initiative

- Policy and Innovation Initiative

- Rapid Decarbonization Initiative

- Stanford Latino Entrepreneurship Initiative

- Value Chain Innovation Initiative

- Venture Capital Initiative

- Career & Success

- Climate & Sustainability

- Corporate Governance

- Culture & Society

- Finance & Investing

- Government & Politics

- Leadership & Management

- Markets and Trade

- Operations & Logistics

- Opportunity & Access

- Technology & AI

- Opinion & Analysis

- Email Newsletter

Welcome, Alumni

- Communities

- Digital Communities & Tools

- Regional Chapters

- Women’s Programs

- Identity Chapters

- Find Your Reunion

- Career Resources

- Job Search Resources

- Career & Life Transitions

- Programs & Webinars

- Career Video Library

- Alumni Education

- Research Resources

- Volunteering

- Alumni News

- Class Notes

- Alumni Voices

- Contact Alumni Relations

- Upcoming Events

Admission Events & Information Sessions

- MBA Program

- MSx Program

- PhD Program

- Alumni Events

- All Other Events

- Requirements

- Requirements: Behavioral

- Requirements: Quantitative

- Requirements: Macro

- Requirements: Micro

- Annual Evaluations

- Field Examination

- Research Activities

- Research Papers

- Dissertation

- Oral Examination

- Current Students

- Entering Class Profile

- Education & CV

- GMAT & GRE

- International Applicants

- Statement of Purpose

- Letters of Recommendation

- Reapplicants

- Application Fee Waiver

- Deadline & Decisions

- Job Market Candidates

- Academic Placements

- Stay in Touch

- Fields of Study

- Student Life

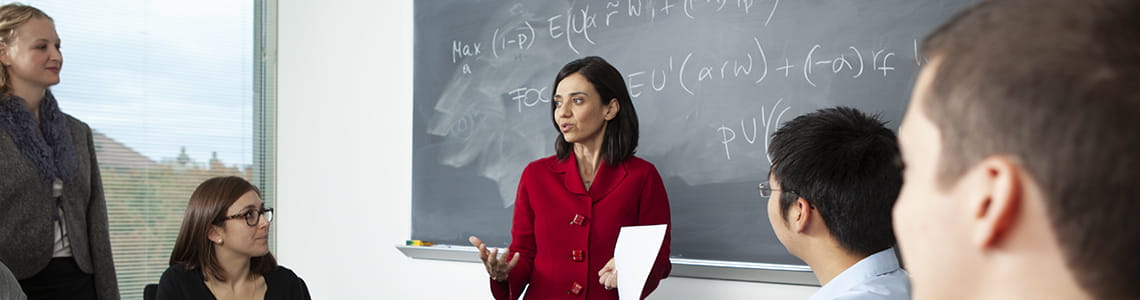

The field of finance covers the economics of claims on resources. Financial economists study the valuation of these claims, the markets in which they are traded, and their use by individuals, corporations, and the society at large.

At Stanford GSB, finance faculty and doctoral students study a wide spectrum of financial topics, including the pricing and valuation of assets, the behavior of financial markets, and the structure and financial decision-making of firms and financial intermediaries.

Investigation of issues arising in these areas is pursued both through the development of theoretical models and through the empirical testing of those models. The PhD Program is designed to give students a good understanding of the methods used in theoretical modeling and empirical testing.

Preparation and Qualifications

All students are required to have, or to obtain during their first year, mathematical skills at the level of one year of calculus and one course each in linear algebra and matrix theory, theory of probability, and statistical inference.

Students are expected to have familiarity with programming and data analysis using tools and software such as MATLAB, Stata, R, Python, or Julia, or to correct any deficiencies before enrolling at Stanford.

The PhD program in finance involves a great deal of very hard work, and there is keen competition for admission. For both these reasons, the faculty is selective in offering admission. Prospective applicants must have an aptitude for quantitative work and be at ease in handling formal models. A strong background in economics and college-level mathematics is desirable.

It is particularly important to realize that a PhD in finance is not a higher-level MBA, but an advanced, academically oriented degree in financial economics, with a reflective and analytical, rather than operational, viewpoint.

Faculty in Finance

Anat r. admati, juliane begenau, jonathan b. berk, michael blank, greg buchak, antonio coppola, darrell duffie, steven grenadier, benjamin hébert, arvind krishnamurthy, hanno lustig, matteo maggiori, paul pfleiderer, joshua d. rauh, claudia robles-garcia, ilya a. strebulaev, vikrant vig, jeffrey zwiebel, emeriti faculty, robert l. joss, george g.c. parker, myron s. scholes, william f. sharpe, kenneth j. singleton, james c. van horne, recent publications in finance, dollar safety and the global financial cycle, monetary tightening and u.s. bank fragility in 2023: mark-to-market losses and uninsured depositor runs, trading stocks builds financial confidence and compresses the gender gap, recent insights by stanford business, a “grumpy economist” weighs in on inflation’s causes — and its cures, the surprising economic upside to money in u.s. politics, your summer 2024 podcast playlist.

- See the Current DEI Report

- Supporting Data

- Research & Insights

- Share Your Thoughts

- Search Fund Primer

- Teaching & Curriculum

- Affiliated Faculty

- Faculty Advisors

- Louis W. Foster Resource Center

- Defining Social Innovation

- Impact Compass

- Global Health Innovation Insights

- Faculty Affiliates

- Student Awards & Certificates

- Changemakers

- Dean Jonathan Levin

- Dean Garth Saloner

- Dean Robert Joss

- Dean Michael Spence

- Dean Robert Jaedicke

- Dean Rene McPherson

- Dean Arjay Miller

- Dean Ernest Arbuckle

- Dean Jacob Hugh Jackson

- Dean Willard Hotchkiss

- Faculty in Memoriam

- Stanford GSB Firsts

- Annual Alumni Dinner

- Class of 2024 Candidates

- Certificate & Award Recipients

- Dean’s Remarks

- Keynote Address

- Teaching Approach

- Analysis and Measurement of Impact

- The Corporate Entrepreneur: Startup in a Grown-Up Enterprise

- Data-Driven Impact

- Designing Experiments for Impact

- Digital Marketing

- The Founder’s Right Hand

- Marketing for Measurable Change

- Product Management

- Public Policy Lab: Financial Challenges Facing US Cities

- Public Policy Lab: Homelessness in California

- Lab Features

- Curricular Integration

- View From The Top

- Formation of New Ventures

- Managing Growing Enterprises

- Startup Garage

- Explore Beyond the Classroom

- Stanford Venture Studio

- Summer Program

- Workshops & Events

- The Five Lenses of Entrepreneurship

- Leadership Labs

- Executive Challenge

- Arbuckle Leadership Fellows Program

- Selection Process

- Training Schedule

- Time Commitment

- Learning Expectations

- Post-Training Opportunities

- Who Should Apply

- Introductory T-Groups

- Leadership for Society Program

- Certificate

- 2024 Awardees

- 2023 Awardees

- 2022 Awardees

- 2021 Awardees

- 2020 Awardees

- 2019 Awardees

- 2018 Awardees

- Social Management Immersion Fund

- Stanford Impact Founder Fellowships

- Stanford Impact Leader Prizes

- Social Entrepreneurship

- Stanford GSB Impact Fund

- Economic Development

- Energy & Environment

- Stanford GSB Residences

- Environmental Leadership

- Stanford GSB Artwork

- A Closer Look

- California & the Bay Area

- Voices of Stanford GSB

- Business & Beneficial Technology

- Business & Sustainability

- Business & Free Markets

- Business, Government, and Society Forum

- Get Involved

- Second Year

- Global Experiences

- JD/MBA Joint Degree

- MA Education/MBA Joint Degree

- MD/MBA Dual Degree

- MPP/MBA Joint Degree

- MS Computer Science/MBA Joint Degree

- MS Electrical Engineering/MBA Joint Degree

- MS Environment and Resources (E-IPER)/MBA Joint Degree

- Academic Calendar

- Clubs & Activities

- LGBTQ+ Students

- Military Veterans

- Minorities & People of Color

- Partners & Families

- Students with Disabilities

- Student Support

- Residential Life

- Student Voices

- MBA Alumni Voices

- A Week in the Life

- Career Support

- Employment Outcomes

- Cost of Attendance

- Knight-Hennessy Scholars Program

- Yellow Ribbon Program

- BOLD Fellows Fund

- Application Process

- Loan Forgiveness

- Contact the Financial Aid Office

- Evaluation Criteria

- English Language Proficiency

- Personal Information, Activities & Awards

- Professional Experience

- Optional Short Answer Questions

- Application Fee

- Reapplication

- Deferred Enrollment

- Joint & Dual Degrees

- Event Schedule

- Ambassadors

- New & Noteworthy

- Ask a Question

- See Why Stanford MSx

- Is MSx Right for You?

- MSx Stories

- Leadership Development

- How You Will Learn

- Admission Events

- Personal Information

- GMAT, GRE & EA

- English Proficiency Tests

- Career Change

- Career Advancement

- Career Support and Resources

- Daycare, Schools & Camps

- U.S. Citizens and Permanent Residents

- Faculty Mentors

- Current Fellows

- Standard Track

- Fellowship & Benefits

- Group Enrollment

- Program Formats

- Developing a Program

- Diversity & Inclusion

- Strategic Transformation

- Program Experience

- Contact Client Services

- Campus Experience

- Live Online Experience

- Silicon Valley & Bay Area

- Digital Credentials

- Faculty Spotlights

- Participant Spotlights

- Eligibility

- International Participants

- Stanford Ignite

- Frequently Asked Questions

- Operations, Information & Technology

- Organizational Behavior

- Political Economy

- Classical Liberalism

- The Eddie Lunch

- Accounting Summer Camp

- California Econometrics Conference

- California Quantitative Marketing PhD Conference

- California School Conference

- China India Insights Conference

- Homo economicus, Evolving

- Political Economics (2023–24)

- Scaling Geologic Storage of CO2 (2023–24)

- A Resilient Pacific: Building Connections, Envisioning Solutions

- Adaptation and Innovation

- Changing Climate

- Civil Society

- Climate Impact Summit

- Climate Science

- Corporate Carbon Disclosures

- Earth’s Seafloor

- Environmental Justice

- Operations and Information Technology

- Organizations

- Sustainability Reporting and Control

- Taking the Pulse of the Planet

- Urban Infrastructure

- Watershed Restoration

- Junior Faculty Workshop on Financial Regulation and Banking

- Ken Singleton Celebration

- Marketing Camp

- Quantitative Marketing PhD Alumni Conference

- Presentations

- Theory and Inference in Accounting Research

- Stanford Closer Look Series

- Quick Guides

- Core Concepts

- Journal Articles

- Glossary of Terms

- Faculty & Staff

- Subscribe to Corporate Governance Emails

- Researchers & Students

- Research Approach

- Charitable Giving

- Financial Health

- Government Services

- Workers & Careers

- Short Course

- Adaptive & Iterative Experimentation

- Incentive Design

- Social Sciences & Behavioral Nudges

- Bandit Experiment Application

- Conferences & Events

- Reading Materials

- Energy Entrepreneurship

- Faculty & Affiliates

- SOLE Report

- Responsible Supply Chains

- Current Study Usage

- Pre-Registration Information

- Participate in a Study

- Founding Donors

- Program Contacts

- Location Information

- Participant Profile

- Network Membership

- Program Impact

- Collaborators

- Entrepreneur Profiles

- Company Spotlights

- Seed Transformation Network

- Responsibilities

- Current Coaches

- How to Apply

- Meet the Consultants

- Meet the Interns

- Intern Profiles

- Collaborate

- Research Library

- News & Insights

- Databases & Datasets

- Research Guides

- Consultations

- Research Workshops

- Career Research

- Research Data Services

- Course Reserves

- Course Research Guides

- Material Loan Periods

- Fines & Other Charges

- Document Delivery

- Interlibrary Loan

- Equipment Checkout

- Print & Scan

- MBA & MSx Students

- PhD Students

- Other Stanford Students

- Faculty Assistants

- Research Assistants

- Stanford GSB Alumni

- Telling Our Story

- Staff Directory

- Site Registration

- Alumni Directory

- Alumni Email

- Privacy Settings & My Profile

- Event Registration Help

- Success Stories

- The Story of Circles

- Support Women’s Circles

- Stanford Women on Boards Initiative

- Alumnae Spotlights

- Insights & Research

- Industry & Professional

- Entrepreneurial Commitment Group

- Recent Alumni

- Half-Century Club

- Fall Reunions

- Spring Reunions

- MBA 25th Reunion

- Half-Century Club Reunion

- Faculty Lectures

- Ernest C. Arbuckle Award

- Alison Elliott Exceptional Achievement Award

- ENCORE Award

- Excellence in Leadership Award

- John W. Gardner Volunteer Leadership Award

- Robert K. Jaedicke Faculty Award

- Jack McDonald Military Service Appreciation Award

- Jerry I. Porras Latino Leadership Award

- Tapestry Award

- Student & Alumni Events

- Executive Recruiters

- Interviewing

- Land the Perfect Job with LinkedIn

- Negotiating

- Elevator Pitch

- Email Best Practices

- Resumes & Cover Letters

- Self-Assessment

- Whitney Birdwell Ball

- Margaret Brooks

- Bryn Panee Burkhart

- Margaret Chan

- Ricki Frankel

- Peter Gandolfo

- Cindy W. Greig

- Natalie Guillen

- Carly Janson

- Sloan Klein

- Sherri Appel Lassila

- Stuart Meyer

- Tanisha Parrish

- Virginia Roberson

- Philippe Taieb

- Michael Takagawa

- Terra Winston

- Johanna Wise

- Debbie Wolter

- Rebecca Zucker

- Complimentary Coaching

- Changing Careers

- Work-Life Integration

- Career Breaks

- Flexible Work

- Encore Careers

- Join a Board

- D&B Hoovers

- Data Axle (ReferenceUSA)

- EBSCO Business Source

- Global Newsstream

- Market Share Reporter

- ProQuest One Business

- RKMA Market Research Handbook Series

- Student Clubs

- Entrepreneurial Students

- Stanford GSB Trust

- Alumni Community

- How to Volunteer

- Springboard Sessions

- Consulting Projects

- 2020 – 2029

- 2010 – 2019

- 2000 – 2009

- 1990 – 1999

- 1980 – 1989

- 1970 – 1979

- 1960 – 1969

- 1950 – 1959

- 1940 – 1949

- Service Areas

- ACT History

- ACT Awards Celebration

- ACT Governance Structure

- Building Leadership for ACT

- Individual Leadership Positions

- Leadership Role Overview

- Purpose of the ACT Management Board

- Contact ACT

- Business & Nonprofit Communities

- Reunion Volunteers

- Ways to Give

- Fiscal Year Report

- Business School Fund Leadership Council

- Planned Giving Options

- Planned Giving Benefits

- Planned Gifts and Reunions

- Legacy Partners

- Giving News & Stories

- Giving Deadlines

- Development Staff

- Submit Class Notes

- Class Secretaries

- Board of Directors

- Health Care

- Sustainability

- Class Takeaways

- All Else Equal: Making Better Decisions

- If/Then: Business, Leadership, Society

- Grit & Growth

- Think Fast, Talk Smart

- Spring 2022

- Spring 2021

- Autumn 2020

- Summer 2020

- Winter 2020

- In the Media

- For Journalists

- DCI Fellows

- Other Auditors

- Academic Calendar & Deadlines

- Course Materials

- Entrepreneurial Resources

- Campus Drive Grove

- Campus Drive Lawn

- CEMEX Auditorium

- King Community Court

- Seawell Family Boardroom

- Stanford GSB Bowl

- Stanford Investors Common

- Town Square

- Vidalakis Courtyard

- Vidalakis Dining Hall

- Catering Services

- Policies & Guidelines

- Reservations

- Contact Faculty Recruiting

- Lecturer Positions

- Postdoctoral Positions

- Accommodations

- CMC-Managed Interviews

- Recruiter-Managed Interviews

- Virtual Interviews

- Campus & Virtual

- Search for Candidates

- Think Globally

- Recruiting Calendar

- Recruiting Policies

- Full-Time Employment

- Summer Employment

- Entrepreneurial Summer Program

- Global Management Immersion Experience

- Social-Purpose Summer Internships

- Process Overview

- Project Types

- Client Eligibility Criteria

- Client Screening

- ACT Leadership

- Social Innovation & Nonprofit Management Resources

- Develop Your Organization’s Talent

- Centers & Initiatives

- Student Fellowships

- Youth Program

- Wharton Online

PhD Program

- Program of Study

Wharton’s PhD program in Finance provides students with a solid foundation in the theoretical and empirical tools of modern finance, drawing heavily on the discipline of economics.

The department prepares students for careers in research and teaching at the world’s leading academic institutions, focusing on Asset Pricing and Portfolio Management, Corporate Finance, International Finance, Financial Institutions and Macroeconomics.

Wharton’s Finance faculty, widely recognized as the finest in the world, has been at the forefront of several areas of research. For example, members of the faculty have led modern innovations in theories of portfolio choice and savings behavior, which have significantly impacted the asset pricing techniques used by researchers, practitioners, and policymakers. Another example is the contribution by faculty members to the analysis of financial institutions and markets, which is fundamental to our understanding of the trade-offs between economic systems and their implications for financial fragility and crises.

Faculty research, both empirical and theoretical, includes such areas as:

- Structure of financial markets

- Formation and behavior of financial asset prices

- Banking and monetary systems

- Corporate control and capital structure

- Saving and capital formation

- International financial markets

Candidates with undergraduate training in economics, mathematics, engineering, statistics, and other quantitative disciplines have an ideal background for doctoral studies in this field.

Effective 2023, The Wharton Finance PhD Program is now STEM certified.

- Course Descriptions

- Course Schedule

- Dissertation Committee and Proposal Defense

- Meet our PhD Students

- Visiting Scholars

More Information

- Apply to Wharton

- Doctoral Inside: Resources for Current PhD Students

- Wharton Doctoral Program Policies

- Transfer of Credit

- Research Fellowship

PhD | Finance

The Ph.D. in Finance

Stern’s Ph.D. program in finance trains scholars to conduct research at the leading edge of financial economics. The faculty represents one of the largest finance research groups in the world that has been ranked consistently as the leading publisher of academic research in top finance journals. Comprised of more than 40 researchers, including a Nobel-prize-winning economist, our faculty are active in all areas of finance—asset pricing, corporate finance, derivatives, market microstructure, and behavioral finance—with both theoretical and empirical focus, and with emerging specialization in the areas of financial intermediation, crises, and macro-finance. As a result of this unusual breadth, students have access to expertise in almost any topic that they might wish to explore.

Explore Finance

Discover our other fields of study.

- Doctoral Programs

Financial economics encompasses a broad area of topics and issues, including corporate investments and financing policy, security valuation, portfolio management, the behavior of prices in speculative markets, financial institutions, and intermediation.

The PhD specialization in finance is designed to give the student a strong background for study and research in both theoretical and empirical work in finance and related areas. Emphasis is placed on understanding the important concepts and models. Students normally take several graduate courses in the Department of Economics, particularly in microeconomics and macroeconomic theory, the economics of uncertainty, and econometrics.

The program offers two courses specifically in financial theory and its applications. In addition, the faculty and doctoral students attend a seminar that features speakers from around the country. However, the specialization is built primarily around individual study and research under the guidance of the faculty.

Examples of potential areas of research for the financial economics dissertation:

- Principal-agent relationships

- Financial intermediation

- Efficiency of markets

- Portfolio selection

- Youth Program

- Wharton Online

Wharton’s PhD program in Finance provides students with a solid foundation in the theoretical and empirical tools of modern finance, drawing heavily on the discipline of economics.

The department prepares students for careers in research and teaching at the world’s leading academic institutions, focusing on Asset Pricing and Portfolio Management, Corporate Finance, International Finance, Financial Institutions and Macroeconomics.

Wharton’s Finance faculty, widely recognized as the finest in the world, has been at the forefront of several areas of research. For example, members of the faculty have led modern innovations in theories of portfolio choice and savings behavior, which have significantly impacted the asset pricing techniques used by researchers, practitioners, and policymakers. Another example is the contribution by faculty members to the analysis of financial institutions and markets, which is fundamental to our understanding of the trade-offs between economic systems and their implications for financial fragility and crises.

Faculty research, both empirical and theoretical, includes such areas as:

- Structure of financial markets

- Formation and behavior of financial asset prices

- Banking and monetary systems

- Corporate control and capital structure

- Saving and capital formation

- International financial markets

For information on courses and sample plan of study, please visit the University Graduate Catalog .

Get the Details.

Visit the Finance website for details on program requirements and courses. Read faculty and student research and bios to see what you can do with a Finance PhD.

Finance Doctoral Coordinator Prof. Luke Taylor John B. Neff Associate Professor in Finance, Professor of Finance Co-Director, Rodney L. White Center for Financial Research Email: [email protected] Phone: (215) 898-4802

Areas of Research

- Students & Placements

- [email protected]

- (517) 353-1745

Doctoral students devote their third, fourth and potentially fifth years in the program to conduct individual research culminating in a doctoral dissertation. Students gain hands-on experience conducting thorough literature reviews; developing and writing conceptual framework and hypotheses development sections; collecting and analyzing data using advanced statistical methods; and supporting why their research is relevant.

Doctoral students in finance have the opportunity to work with some of the leading researchers in the field. Key areas of research within the Ph.D. in Finance department include:

- Corporate Finance

- International Finance

- Financial Intermediation

- Financial Markets

- Behavioral Finance

- Empirical Investments

- Theoretical Asset Pricing

Publications

Interacting and collaborating with our outstanding research professionals is one of the key benefits of being a Ph.D. student in the Department of Finance. Published papers that have involved collaboration between Ph.D. students and researchers in the department include (Ph.D. students and graduates in bold):

Chaudhuri, Ranadeb , Zoran Ivković , and Andrei Simonov “What About Nurture? Financial Decision-Making and Growing Up”, working paper.

Grieser, William, Rachel Li , and Andrei Simonov “Integrity, Creativity, and Corporate Culture”, working paper.

Chaudhuri, Ranadeb , and Mark Schroder, “Monotonicity of the Stochastic Discount Factor and Expected Option Returns,” Review of Financial Studies , 28 (2015), 1462-1505.

Butler, Kirt, Tom O’Brien , and Gwinyai Utete , “A Fresh Look at Cross-Border Valuation and FX Hedging Decisions,” Journal of Applied Finance 23 (2), 2013.

Finance @ Broad

Get connected with broad:.

- Business College Complex

- 632 Bogue St

- East Lansing, MI 48824

50+ Best Finance Dissertation Topics For Research Students In 2024

Link Copied

Share on Facebook

Share on Twitter

Share on LinkedIn

Finance Dissertation Made Easier!

Embarking on your dissertation adventure? Look no further! Choosing the right finance dissertation topics is like laying the foundation for your research journey in finance, and we're here to light up your path. In this article, we will be diving deep into why dissertation topics in finance matter so much. We've got some golden writing tips to share with you! We're also unveiling the secret recipe for structuring a stellar finance dissertation and exploring intriguing topics across various finance sub-fields. Here is a list of finance dissertation topics that will surely set your research spirit on fire!

What is a Finance Dissertation?

Finance dissertations are academic papers that delve into specific finance topics chosen by students, covering areas such as stock markets , banking , risk management , and healthcare finance . These dissertations require extensive research to create a compelling report and contribute to the student's confidence and satisfaction in the field of finance. Now, let's understand why these dissertations are so important and why choosing the right finance dissertation topics is crucial!

Importance of Finance Dissertation Topics

Choosing the dissertation topics for finance students is essential as it will influence the course of one’s research. It determines the direction and scope of your study. You must make sure that the finance dissertation topics you choose are relevant to your field of interest. Here are a few reasons why finance thesis topics are important:

1. Relevance

Opting for relevant finance thesis topics ensures that your research contributes to the existing body of knowledge and addresses contemporary issues in finance. Choosing a dissertation topic relevant to the industry can make a meaningful impact and advance understanding in your chosen area.

2. Personal Interest

Selecting finance dissertation topics that align with your interests and career goals is vital. When genuinely passionate about your research area, you are more likely to stay motivated during the dissertation process. Your interest will drive you to explore the subject thoroughly and produce high-quality work.

3. Future Opportunities

Well-chosen finance dissertation topics can open doors to various future opportunities. They can enhance your employability by showcasing your expertise in a specific finance area . They may also lead to potential research collaborations and invitations to conferences in your field of interest.

4. Academic Supervision

Your choice of topics for dissertation in finance also influences the availability of academic supervisors with expertise in your chosen area. Selecting a well-defined research area increases the likelihood of finding a supervisor to guide you effectively throughout the dissertation . Their knowledge and guidance will greatly contribute to the success of your research.

Writing Tips for Finance Dissertation

Writing a dissertation requires a lot of planning , formatting , and structuring . It starts with deciding on topics for a dissertation in finance, conducting tons of research, deciding on methods, and so on. Below are some tips to assist you along the way, and here is a blog on the 10 tips on writing a dissertation that can give you more information, should you need it!

1. Select a Manageable Topic

It is important to choose finance research topics within the given timeframe and resources. Select a research area that interests you and aligns with your career goals. This will help you stay inspired throughout the dissertation process.

2. Conduct a Thorough Literature Review

A comprehensive literature review forms the backbone of your research. After choosing the finance dissertation topics, dive deep into academic papers , books , and industry reports . Gain a solid understanding of your chosen area to identify research gaps and establish the significance of your study.

3. Define Clear Research Objectives

Clearly define your dissertation's research questions and objectives. It will provide a clear direction for your research and guide your data collection, analysis, and overall structure. Ensure your objectives are specific , measurable , achievable , relevant , and time-bound (SMART).

4. Collect and Analyse Data

Depending on your research methodology and your finance dissertation topics, collect and analyse relevant data to support your findings. It may involve conducting surveys , interviews , experiments , and analysing existing datasets . Choose appropriate statistical techniques and qualitative methods to derive meaningful insights from your data.

5. Structure and Organisation

Pay attention to the structure and organisation of your dissertation. Follow a logical progression of chapters and sections, ensuring that each chapter contributes to the overall coherence of your study. Use headings , subheadings , and clear signposts to guide the reader through your work.

6. Proofread and Edit

Once you have completed the writing process, take the time to proofread and edit your dissertation carefully. Check for clarity , coherence , and proper grammar . Ensure that your arguments are well-supported, and eliminate any inconsistencies or repetitions. Pay attention to formatting, citation styles, and consistency in referencing throughout your dissertation.

Don't let student accommodation hassles derail your finance research.

Book through amber today!

Finance Dissertation Topics

Now that you know what a finance dissertation is and why they are important, it's time to have a look at some of the best finance dissertation topics. For your convenience, we have segregated these topics into categories, including cryptocurrency , risk management , internet banking , and so many more. So, let's dive right in and explore the best finance dissertation topics:

Dissertation Topics in Finance Related to Cryptocurrency

1. The Impact of Regulatory Frameworks on the Volatility and Liquidity of Cryptocurrencies. 2. Exploring the Factors Influencing Cryptocurrency Adoption: A Comparative Study. 3. Assessing the Efficiency and Market Integration of Cryptocurrency Exchanges. 4. An Analysis of the Relationship between Cryptocurrency Prices and Macroeconomic Factors. 5. The Role of Initial Coin Offerings (ICOs) in Financing Startups: Opportunities and Challenges.

Dissertation Topics in Finance Related to Risk Management

1. The Effectiveness of Different Risk Management Strategies in Mitigating Financial Risks in Banking Institutions. 2. The Role of Derivatives in Hedging Financial Risks: A Comparative Study. 3. Analysing the Impact of Risk Management Practices on Firm Performance: A Case Study of a Specific Industry. 4. The Use of Stress Testing in Evaluating Systemic Risk: Lessons from the Global Financial Crisis. 5. Assessing the Relationship between Corporate Governance and Risk Management in Financial Institutions.

Dissertation Topics in Finance Related to Internet Banking

1. Customer Adoption of Internet Banking: An Empirical Study on Factors Influencing Usage. 2. Enhancing Security in Internet Banking: Exploring Biometric Authentication Technologies. 3. The Impact of Mobile Banking Applications on Customer Engagement and Satisfaction. 4. Evaluating the Efficiency and Effectiveness of Internet Banking Services in Emerging Markets. 5. The Role of Social Media in Shaping Customer Perception and Adoption of Internet Banking. 6. Fraud and Identity Theft are Accomplished via Internet Banking.

Dissertation Topics in Finance Related to Microfinance

1. The Impact of Microfinance on Poverty Alleviation: A Comparative Study of Different Models. 2. Exploring the Role of Microfinance in Empowering Women Entrepreneurs. 3. Assessing the Financial Sustainability of Microfinance Institutions in Developing Countries. 4. The Effectiveness of Microfinance in Promoting Rural Development: Evidence from a Specific Region. 5. Analysing the Relationship between Microfinance and Entrepreneurial Success: A Longitudinal Study.

Dissertation Topics in Finance Related to Retail and Commercial Banking

1. The Impact of Digital Transformation on Retail and Commercial Banking: A Case Study of a Specific Bank. 2. Customer Satisfaction and Loyalty in Retail Banking: An Analysis of Service Quality Dimensions. 3. Analysing the Relationship between Bank Branch Expansion and Financial Performance. 4. The Role of Fintech Startups in Disrupting Retail and Commercial Banking: Opportunities and Challenges. 5. Assessing the Impact of Mergers and Acquisitions on the Performance of Retail and Commercial Banks.

Dissertation Topics in Finance Related to Alternative Investment

1. The Performance and Risk Characteristics of Hedge Funds: A Comparative Analysis. 2. Exploring the Role of Private Equity in Financing and Growing Small and Medium-Sized Enterprises. 3. Analysing the Relationship between Real Estate Investments and Portfolio Diversification. 4. The Potential of Impact Investing: Evaluating the Social and Financial Returns. 5. Assessing the Risk-Return Tradeoff in Cryptocurrency Investments: A Comparative Study.

Dissertation Topics in Finance Related to International Affairs

1. The Impact of Exchange Rate Volatility on International Trade: A Case Study of a Specific Industry. 2. Analysing the Effectiveness of Capital Controls in Managing Financial Crises: Comparative Study of Different Countries. 3. The Role of International Financial Institutions in Promoting Economic Development in Developing Countries. 4. Evaluating the Implications of Trade Wars on Global Financial Markets. 5. Assessing the Role of Central Banks in Managing Financial Stability in a Globalised Economy.

Dissertation Topics in Finance Related to Sustainable Finance

1. The Impact of Sustainable Investing on Financial Performance. 2. The Role of Green Bonds in Financing Climate Change Mitigation and Adaptation. 3. The Development of Carbon Markets. 4. The Use of Environmental, Social, and Governance (ESG) Factors in Investment Decision-Making. 5. The Challenges and Opportunities of Sustainable Finance in Emerging Markets.

Dissertation Topics in Finance Related to Investment Banking

1. The Valuation of Distressed Assets. 2. The Pricing of Derivatives. 3. The Risk Management of Financial Institutions. 4. The Regulation of Investment Banks. 5. The Impact of Technology on the Investment Banking Industry.

Dissertation Topics in Finance Related to Actuarial Science

1. The Development of New Actuarial Models for Pricing Insurance Products. 2. The Use of Big Data in Actuarial Analysis. 3. The Impact of Climate Change on Insurance Risk. 4. The Design of Pension Plans That Are Sustainable in the Long Term. 5. The Use of Actuarial Science to Manage Risk in Other Industries, Such as Healthcare and Finance.

Dissertation Topics in Finance Related to Corporate Finance

1. Study the Relations Between Corporate Governance Structures and Financial Performance 2. Testing the Effects of Capital Structure on Firm Performance Across Different Industries 3. Effectiveness of Financial Management Practices in Emerging Markets 4. Integrating Sustainability and CSR Initiatives Impacts a Corporation’s Financial Performance and Enhances its Brand Reputation. 5. A Comparative Study of the Financing Strategies Employed in Mergers and Acquisitions.

Tips To Find Good Finance Dissertation Topics

Embarking on a journey of dissertation reports on finance topics requires careful consideration of various factors. Your choice of topic in finance research topics is pivotal, as it sets the stage for the entire research process. We suggest the following tips that can help you pick the perfect dissertation topic:

1. Identify your interests and strengths 2. Check for current relevance 3. Feedback from your superiors 4. Finalise the research methods 5. Gather the data 6. Work on the outline of your dissertation 7. Make a draft and proofread it

How To Plan Your Work on a Finance Dissertation?

The students are expected to submit their dissertation by the end of the study course. Students are prone to face a lot of difficulties while working on their dissertation. In such cases, proper planning may be your best bet! Keep in mind that the main aim of writing a dissertation is an opportunity to demonstrate the depths of your research abilities. We are providing you with a short step-by-step guide that will help you plan your work.

1. Choose a topic that interests you 2. Make sure to discuss the same with your supervisor 3. Post-discussion, work on the feedback given by the supervisor 4. Narrow down the research methods that will prove the significance of your chosen topic 5. Gather all the required information from relevant sources 6. Analyse the acquired results after a thorough research 7. Prepare a draft and proofread it 8. Connect with your supervisor/advisor and see if any additions are to be made 9. Make the required edits 10. Prepare the final dissertation

Lastly, we have discussed the importance of finance thesis topics and provided valuable writing tips and tips for finding the right topic. We have also presented a list of thesis topics for finance students within various subfields. With this, we hope you have great ideas for finance dissertations. Good luck with your finance research journey!

Frequently Asked Questions

How do i choose a dissertation topic in finance, what is the best topic for a thesis in finance, where can i find a dissertation topic in finance, what is the recommended length for a finance dissertation, how do you write a dissertation in finance.

Your ideal student home & a flight ticket awaits

Follow us on :

Related Posts

Top 10 Film Schools in New York in 2024!

Explore 15 Best Short Certificate Programs That Pay Well in 2024!

Education As An Investment: 12 Key Reasons to Consider in 2024

amber © 2024. All rights reserved.

4.8/5 on Trustpilot

Rated as "Excellent" • 4800+ Reviews by students

Rated as "Excellent" • 4800+ Reviews by Students

The Experience

- Career Impact

- Global Opportunities

- Inclusion + Belonging

- History + Legacy

- Convocation Ceremony

Academic Expertise

- AI + Data Analytics

- Family Business

- Social Impact + Sustainability

- Entrepreneurship

Degree Programs

- Full-Time MBA

- Executive MBA

- Master in Management

- Evening & Weekend MBA

- Certificate Program for Undergraduates

- Which Program is Right for Me?

- Admissions Events

- Academic Calendars

Executive Education

- Online Programs

- Programs for Individuals

- Nonprofit Programs

- Programs for Groups

- The Kellogg Advantage

- Contact Executive Education

- Request a Brochure

- Find a Program

- Alumni Network

- Career Journeys

- Global Impact

- Student Stories

- Applying to Kellogg

- Inclusion and Belonging

Publications and blogs

- Kellogg Magazine

- Kellogg Insight

- See All News + Stories

Academics + Research

- Faculty Directory

- Institutes + Centers

- Case Studies

- Faculty Teaching Awards

- Academic Departments

- Research + Books

- Faculty Recruiting

- Evening + Weekend MBA

- Deferred Enrollment

- PhD / Doctoral

- Undergraduate Certificate

Additional resources

- Tuition + Financial Aid

- Log into my account portal

- Companies + Recruiters

- Keep in contact

- Attend an Event

Take Action

Financial economics.

Kellogg Opens Its Global Hub

- Accounting Information & Management

- Management & Organizations

- Management & Organizations & Sociology

- Managerial Economics & Strategy

- Operations Management

- Academic Experience

- Student Life

- Frequently Asked Questions (FAQ’s)

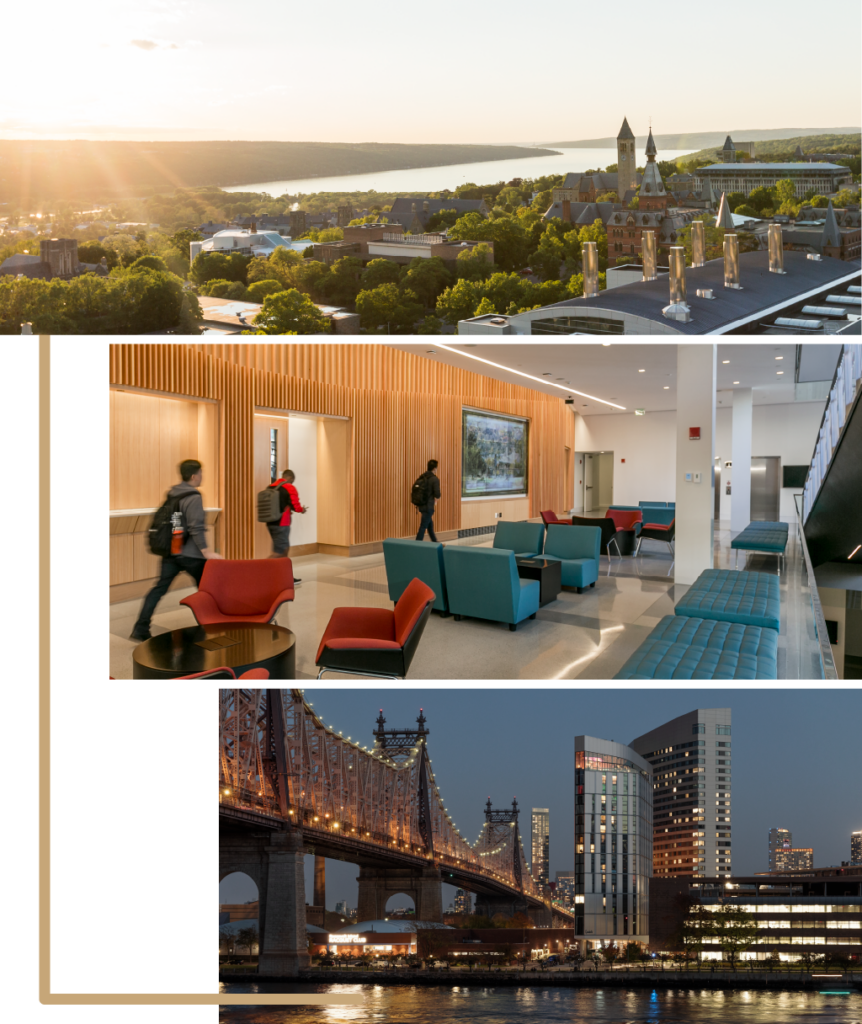

The Financial Economics PhD program is a joint degree offered through the Finance Department at the Kellogg School of Management and the Economics Department at the Weinberg College of Arts and Sciences.

Students within Financial Economics will have access to a broad array of faculty across a variety of disciplines within economics, tapping into the interdisciplinary strengths found within our Finance-Economics curriculum. Additionally, this program benefits by location – our Economics department, PhD students, and research faculty are conveniently located within our new building, the Global Hub, just one floor down from the Finance department.

Some of the most active areas of current research are at the intersection of economics and finance. The aim of the Financial Economics program is to leverage the close ties and common research interests of the Economics Department and the Finance Department at Northwestern to train PhD students interested in these interdisciplinary areas. Students are required to do coursework in multiple fields in economics and finance, and are exposed to the most up-to-date models and methods in these fields. Faculty members from both departments supervise students as they develop their own research projects. PhD students also benefit from close collaborations with students in both departments, and participate in weekly seminar series that draw faculty and PhD students together for scholarly discussions across common research areas, including finance, macroeconomics, industrial organization, development economics, economic theory, and more. The program aims to produce scholars who can be successful in both economics and finance departments.

Active Research Areas : The study of finance aligns with numerous areas within economics: macroeconomics, public finance, econometrics, household finance, economic development and economic history. This is why broad training in economics is essential for those who wish to do innovative work that straddles both finance and economics. Some examples include the financing and investment decisions of firms, households and governments; the interplay between asset prices, capital markets and the macro-economy; and the role and limitations of financial institutions in facilitating access to credit.

Financial Economics PhD students will collaborate with world-renown scholars within our Finance and Economics departments. They include elected fellows of the American Academy of Arts and Sciences, the Econometric Society, the Society for Financial Econometrics, and the National Bureau of Economic Research. They serve/served as directors of the American Finance Association and past-presidents of the Econometric Society and Western Finance Association. Several faculty serve/served in editorial positions at leading journals, such as the American Economic Review , Econometrica , Journal of Economic Theory , Journal of Finance and RAND Journal of Economics . Recent publications within top economics and finance journals include American Economic Review , Econometrica , Journal of Finance , Journal of Financial Economics, Journal of Political Economy, Review of Economic Studies, and Quarterly Journal of Economics.

What We Are Looking for in Applicants

We seek students with strong training in mathematics and statistics and a solid background in economics, either through prior study or through work and research experience. Recommended coursework at an advanced level includes calculus, linear algebra, optimization, probability and statistics . Prior research experience is not required.

There are two points of entry into the Financial Economics program: as a new graduate student to Northwestern or as a transfer student from either the Economics or Finance PhD programs.

- New Graduate Student to Northwestern – Applicants submit one application to the Financial Economics PhD Program that is reviewed by both Finance and Economics faculty, who then render a joint admission decision. Students enter the program as a first-year PhD student.

- Transfer Student – Economics or Finance PhD students who are completing their first year of study and have satisfied all the requirements within Economics may apply for a transfer by contacting the Director of Graduate Study in the program they are currently enrolled in. Applications must be approved by both the Economics and the Finance admissions committees. If the application is approved, the student will initiate a degree transfer request to The Graduate School.

Program Requirements

Coursework In years one and two, students take three or four courses each quarter (fall, winter, spring). The first-year students complete the three core sequences in Microeconomics, Macroeconomics and Econometrics. In year two, students enroll in a minimum of nine approved courses including at least two courses from the sequence in asset pricing, at least two course in corporate finance, two economics field sequence of at least two quarters each, and at least one course in economic history. Students must maintain a minimum 3.0 grade point average (GPA).

Qualifying Exam At the end of year one, students are required to establish competence in the three cores areas of study: Microeconomics, Macroeconomics, and Econometrics. This competence is satisfied by achieving a 3.0 GPA in each of the three-courses sequences.

During the summer following the student’s second year of study, students must pass a comprehensive qualifying exam designed to measure competence in both asset pricing and corporate finance or they demonstrate competence by maintaining a 3.6 GPA average across both course sequences.

Candidacy As students transition from coursework to research, they are required to write an original research paper in the summer of their second year supervised by a faculty advisor. Students present their completed research project to the faculty of the joint program in September following the summer quarter of their second year. At that time, their performance is reviewed by the faculty of the joint program, and upon successfully completing their coursework, passing of their qualifying exam and second-year paper, students are admitted to candidacy.

Third-Year Paper A second paper is typically completed by winter quarter of the third year and presented during the Economics 501 seminar of spring quarter of the third year. The research paper has to be sufficiently advanced to be part of the student's dissertation.