- Newsletters

- Best Industries

- Business Plans

- Home-Based Business

- The UPS Store

- Customer Service

- Black in Business

- Your Next Move

- Female Founders

- Best Workplaces

- Company Culture

- Public Speaking

- HR/Benefits

- Productivity

- All the Hats

- Digital Transformation

- Artificial Intelligence

- Bringing Innovation to Market

- Cloud Computing

- Social Media

- Data Detectives

- Exit Interview

- Bootstrapping

- Crowdfunding

- Venture Capital

- Business Models

- Personal Finance

- Founder-Friendly Investors

- Upcoming Events

- Inc. 5000 Vision Conference

- Become a Sponsor

- Cox Business

- Verizon Business

- Branded Content

- Apply Inc. 5000 US

Inc. Premium

How to Write the Financial Section of a Business Plan

An outline of your company's growth strategy is essential to a business plan, but it just isn't complete without the numbers to back it up. here's some advice on how to include things like a sales forecast, expense budget, and cash-flow statement..

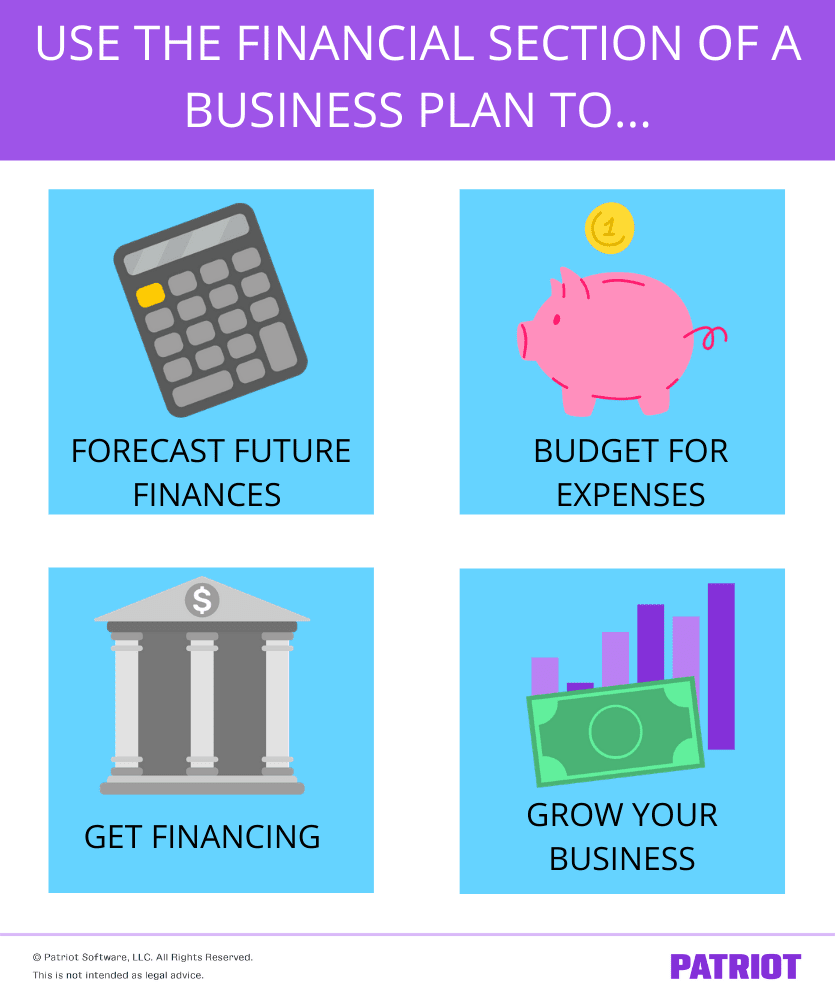

A business plan is all conceptual until you start filling in the numbers and terms. The sections about your marketing plan and strategy are interesting to read, but they don't mean a thing if you can't justify your business with good figures on the bottom line. You do this in a distinct section of your business plan for financial forecasts and statements. The financial section of a business plan is one of the most essential components of the plan, as you will need it if you have any hope of winning over investors or obtaining a bank loan. Even if you don't need financing, you should compile a financial forecast in order to simply be successful in steering your business. "This is what will tell you whether the business will be viable or whether you are wasting your time and/or money," says Linda Pinson, author of Automate Your Business Plan for Windows (Out of Your Mind 2008) and Anatomy of a Business Plan (Out of Your Mind 2008), who runs a publishing and software business Out of Your Mind and Into the Marketplace . "In many instances, it will tell you that you should not be going into this business." The following will cover what the financial section of a business plan is, what it should include, and how you should use it to not only win financing but to better manage your business.

Dig Deeper: Generating an Accurate Sales Forecast

Editor's Note: Looking for Business Loans for your company? If you would like information to help you choose the one that's right for you, use the questionnaire below to have our partner, BuyerZone, provide you with information for free:

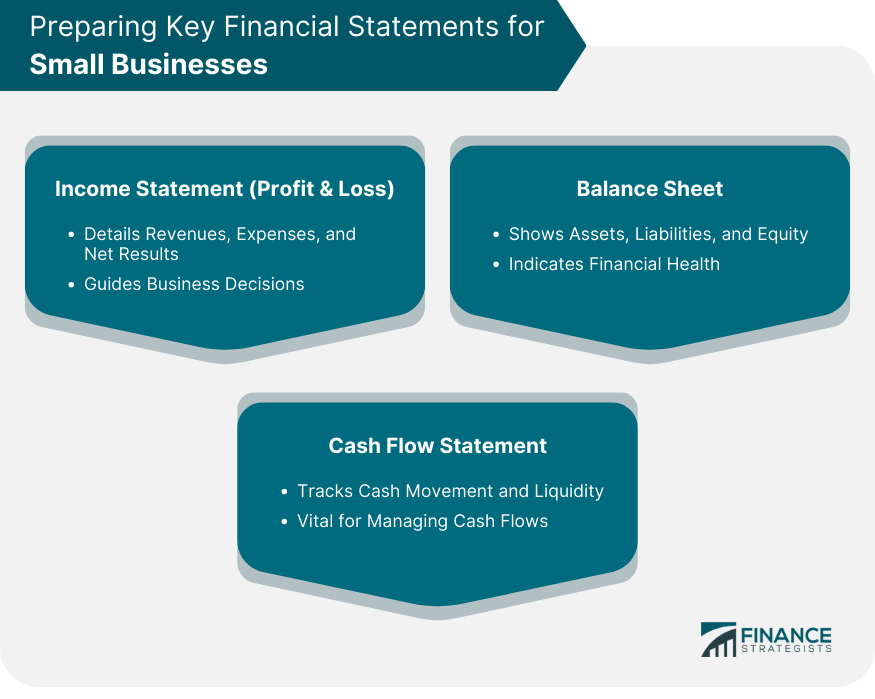

How to Write the Financial Section of a Business Plan: The Purpose of the Financial Section Let's start by explaining what the financial section of a business plan is not. Realize that the financial section is not the same as accounting. Many people get confused about this because the financial projections that you include--profit and loss, balance sheet, and cash flow--look similar to accounting statements your business generates. But accounting looks back in time, starting today and taking a historical view. Business planning or forecasting is a forward-looking view, starting today and going into the future. "You don't do financials in a business plan the same way you calculate the details in your accounting reports," says Tim Berry, president and founder of Palo Alto Software, who blogs at Bplans.com and is writing a book, The Plan-As-You-Go Business Plan. "It's not tax reporting. It's an elaborate educated guess." What this means, says Berry, is that you summarize and aggregate more than you might with accounting, which deals more in detail. "You don't have to imagine all future asset purchases with hypothetical dates and hypothetical depreciation schedules to estimate future depreciation," he says. "You can just guess based on past results. And you don't spend a lot of time on minute details in a financial forecast that depends on an educated guess for sales." The purpose of the financial section of a business plan is two-fold. You're going to need it if you are seeking investment from venture capitalists, angel investors, or even smart family members. They are going to want to see numbers that say your business will grow--and quickly--and that there is an exit strategy for them on the horizon, during which they can make a profit. Any bank or lender will also ask to see these numbers as well to make sure you can repay your loan. But the most important reason to compile this financial forecast is for your own benefit, so you understand how you project your business will do. "This is an ongoing, living document. It should be a guide to running your business," Pinson says. "And at any particular time you feel you need funding or financing, then you are prepared to go with your documents." If there is a rule of thumb when filling in the numbers in the financial section of your business plan, it's this: Be realistic. "There is a tremendous problem with the hockey-stick forecast" that projects growth as steady until it shoots up like the end of a hockey stick, Berry says. "They really aren't credible." Berry, who acts as an angel investor with the Willamette Angel Conference, says that while a startling growth trajectory is something that would-be investors would love to see, it's most often not a believable growth forecast. "Everyone wants to get involved in the next Google or Twitter, but every plan seems to have this hockey stick forecast," he says. "Sales are going along flat, but six months from now there is a huge turn and everything gets amazing, assuming they get the investors' money." The way you come up a credible financial section for your business plan is to demonstrate that it's realistic. One way, Berry says, is to break the figures into components, by sales channel or target market segment, and provide realistic estimates for sales and revenue. "It's not exactly data, because you're still guessing the future. But if you break the guess into component guesses and look at each one individually, it somehow feels better," Berry says. "Nobody wins by overly optimistic or overly pessimistic forecasts."

Dig Deeper: What Angel Investors Look For

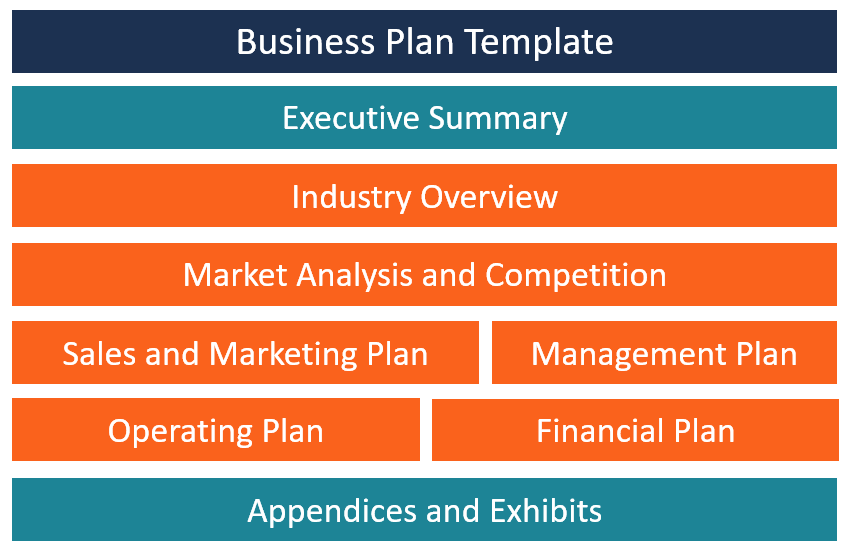

How to Write the Financial Section of a Business Plan: The Components of a Financial Section

A financial forecast isn't necessarily compiled in sequence. And you most likely won't present it in the final document in the same sequence you compile the figures and documents. Berry says that it's typical to start in one place and jump back and forth. For example, what you see in the cash-flow plan might mean going back to change estimates for sales and expenses. Still, he says that it's easier to explain in sequence, as long as you understand that you don't start at step one and go to step six without looking back--a lot--in between.

- Start with a sales forecast. Set up a spreadsheet projecting your sales over the course of three years. Set up different sections for different lines of sales and columns for every month for the first year and either on a monthly or quarterly basis for the second and third years. "Ideally you want to project in spreadsheet blocks that include one block for unit sales, one block for pricing, a third block that multiplies units times price to calculate sales, a fourth block that has unit costs, and a fifth that multiplies units times unit cost to calculate cost of sales (also called COGS or direct costs)," Berry says. "Why do you want cost of sales in a sales forecast? Because you want to calculate gross margin. Gross margin is sales less cost of sales, and it's a useful number for comparing with different standard industry ratios." If it's a new product or a new line of business, you have to make an educated guess. The best way to do that, Berry says, is to look at past results.

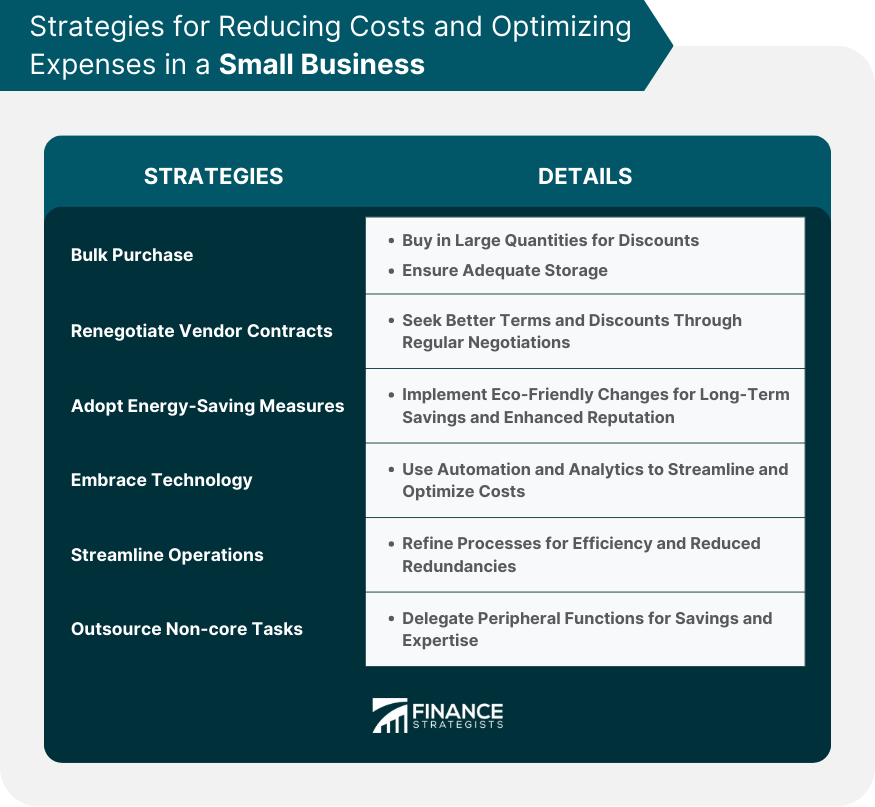

- Create an expenses budget. You're going to need to understand how much it's going to cost you to actually make the sales you have forecast. Berry likes to differentiate between fixed costs (i.e., rent and payroll) and variable costs (i.e., most advertising and promotional expenses), because it's a good thing for a business to know. "Lower fixed costs mean less risk, which might be theoretical in business schools but are very concrete when you have rent and payroll checks to sign," Berry says. "Most of your variable costs are in those direct costs that belong in your sales forecast, but there are also some variable expenses, like ads and rebates and such." Once again, this is a forecast, not accounting, and you're going to have to estimate things like interest and taxes. Berry recommends you go with simple math. He says multiply estimated profits times your best-guess tax percentage rate to estimate taxes. And then multiply your estimated debts balance times an estimated interest rate to estimate interest.

- Develop a cash-flow statement. This is the statement that shows physical dollars moving in and out of the business. "Cash flow is king," Pinson says. You base this partly on your sales forecasts, balance sheet items, and other assumptions. If you are operating an existing business, you should have historical documents, such as profit and loss statements and balance sheets from years past to base these forecasts on. If you are starting a new business and do not have these historical financial statements, you start by projecting a cash-flow statement broken down into 12 months. Pinson says that it's important to understand when compiling this cash-flow projection that you need to choose a realistic ratio for how many of your invoices will be paid in cash, 30 days, 60 days, 90 days and so on. You don't want to be surprised that you only collect 80 percent of your invoices in the first 30 days when you are counting on 100 percent to pay your expenses, she says. Some business planning software programs will have these formulas built in to help you make these projections.

- Income projections. This is your pro forma profit and loss statement, detailing forecasts for your business for the coming three years. Use the numbers that you put in your sales forecast, expense projections, and cash flow statement. "Sales, lest cost of sales, is gross margin," Berry says. "Gross margin, less expenses, interest, and taxes, is net profit."

- Deal with assets and liabilities. You also need a projected balance sheet. You have to deal with assets and liabilities that aren't in the profits and loss statement and project the net worth of your business at the end of the fiscal year. Some of those are obvious and affect you at only the beginning, like startup assets. A lot are not obvious. "Interest is in the profit and loss, but repayment of principle isn't," Berry says. "Taking out a loan, giving out a loan, and inventory show up only in assets--until you pay for them." So the way to compile this is to start with assets, and estimate what you'll have on hand, month by month for cash, accounts receivable (money owed to you), inventory if you have it, and substantial assets like land, buildings, and equipment. Then figure out what you have as liabilities--meaning debts. That's money you owe because you haven't paid bills (which is called accounts payable) and the debts you have because of outstanding loans.

- Breakeven analysis. The breakeven point, Pinson says, is when your business's expenses match your sales or service volume. The three-year income projection will enable you to undertake this analysis. "If your business is viable, at a certain period of time your overall revenue will exceed your overall expenses, including interest." This is an important analysis for potential investors, who want to know that they are investing in a fast-growing business with an exit strategy.

Dig Deeper: How to Price Business Services

How to Write the Financial Section of a Business Plan: How to Use the Financial Section One of the biggest mistakes business people make is to look at their business plan, and particularly the financial section, only once a year. "I like to quote former President Dwight D. Eisenhower," says Berry. "'The plan is useless, but planning is essential.' What people do wrong is focus on the plan, and once the plan is done, it's forgotten. It's really a shame, because they could have used it as a tool for managing the company." In fact, Berry recommends that business executives sit down with the business plan once a month and fill in the actual numbers in the profit and loss statement and compare those numbers with projections. And then use those comparisons to revise projections in the future. Pinson also recommends that you undertake a financial statement analysis to develop a study of relationships and compare items in your financial statements, compare financial statements over time, and even compare your statements to those of other businesses. Part of this is a ratio analysis. She recommends you do some homework and find out some of the prevailing ratios used in your industry for liquidity analysis, profitability analysis, and debt and compare those standard ratios with your own. "This is all for your benefit," she says. "That's what financial statements are for. You should be utilizing your financial statements to measure your business against what you did in prior years or to measure your business against another business like yours." If you are using your business plan to attract investment or get a loan, you may also include a business financial history as part of the financial section. This is a summary of your business from its start to the present. Sometimes a bank might have a section like this on a loan application. If you are seeking a loan, you may need to add supplementary documents to the financial section, such as the owner's financial statements, listing assets and liabilities. All of the various calculations you need to assemble the financial section of a business plan are a good reason to look for business planning software, so you can have this on your computer and make sure you get this right. Software programs also let you use some of your projections in the financial section to create pie charts or bar graphs that you can use elsewhere in your business plan to highlight your financials, your sales history, or your projected income over three years. "It's a pretty well-known fact that if you are going to seek equity investment from venture capitalists or angel investors," Pinson says, "they do like visuals."

Dig Deeper: How to Protect Your Margins in a Downturn

Related Links: Making It All Add Up: The Financial Section of a Business Plan One of the major benefits of creating a business plan is that it forces entrepreneurs to confront their company's finances squarely. Persuasive Projections You can avoid some of the most common mistakes by following this list of dos and don'ts. Making Your Financials Add Up No business plan is complete until it contains a set of financial projections that are not only inspiring but also logical and defensible. How many years should my financial projections cover for a new business? Some guidelines on what to include. Recommended Resources: Bplans.com More than 100 free sample business plans, plus articles, tips, and tools for developing your plan. Planning, Startups, Stories: Basic Business Numbers An online video in author Tim Berry's blog, outlining what you really need to know about basic business numbers. Out of Your Mind and Into the Marketplace Linda Pinson's business selling books and software for business planning. Palo Alto Software Business-planning tools and information from the maker of the Business Plan Pro software. U.S. Small Business Administration Government-sponsored website aiding small and midsize businesses. Financial Statement Section of a Business Plan for Start-Ups A guide to writing the financial section of a business plan developed by SCORE of northeastern Massachusetts.

Editorial Disclosure: Inc. writes about products and services in this and other articles. These articles are editorially independent - that means editors and reporters research and write on these products free of any influence of any marketing or sales departments. In other words, no one is telling our reporters or editors what to write or to include any particular positive or negative information about these products or services in the article. The article's content is entirely at the discretion of the reporter and editor. You will notice, however, that sometimes we include links to these products and services in the articles. When readers click on these links, and buy these products or services, Inc may be compensated. This e-commerce based advertising model - like every other ad on our article pages - has no impact on our editorial coverage. Reporters and editors don't add those links, nor will they manage them. This advertising model, like others you see on Inc, supports the independent journalism you find on this site.

The Daily Digest for Entrepreneurs and Business Leaders

Privacy Policy

- Starting a Business

Our Top Picks

- Best Small Business Loans

- Best Business Internet Service

- Best Online Payroll Service

- Best Business Phone Systems

Our In-Depth Reviews

- OnPay Payroll Review

- ADP Payroll Review

- Ooma Office Review

- RingCentral Review

Explore More

- Business Solutions

- Entrepreneurship

- Franchising

- Best Accounting Software

- Best Merchant Services Providers

- Best Credit Card Processors

- Best Mobile Credit Card Processors

- Clover Review

- Merchant One Review

- QuickBooks Online Review

- Xero Accounting Review

- Financial Solutions

Human Resources

- Best Human Resources Outsourcing Services

- Best Time and Attendance Software

- Best PEO Services

- Best Business Employee Retirement Plans

- Bambee Review

- Rippling HR Software Review

- TriNet Review

- Gusto Payroll Review

- HR Solutions

Marketing and Sales

- Best Text Message Marketing Services

- Best CRM Software

- Best Email Marketing Services

- Best Website Builders

- Textedly Review

- Salesforce Review

- EZ Texting Review

- Textline Review

- Business Intelligence

- Marketing Solutions

- Marketing Strategy

- Public Relations

- Social Media

- Best GPS Fleet Management Software

- Best POS Systems

- Best Employee Monitoring Software

- Best Document Management Software

- Verizon Connect Fleet GPS Review

- Zoom Review

- Samsara Review

- Zoho CRM Review

- Technology Solutions

Business Basics

- 4 Simple Steps to Valuing Your Small Business

- How to Write a Business Growth Plan

- 12 Business Skills You Need to Master

- How to Start a One-Person Business

- FreshBooks vs. QuickBooks Comparison

- Salesforce CRM vs. Zoho CRM

- RingCentral vs. Zoom Comparison

- 10 Ways to Generate More Sales Leads

Business.com aims to help business owners make informed decisions to support and grow their companies. We research and recommend products and services suitable for various business types, investing thousands of hours each year in this process.

As a business, we need to generate revenue to sustain our content. We have financial relationships with some companies we cover, earning commissions when readers purchase from our partners or share information about their needs. These relationships do not dictate our advice and recommendations. Our editorial team independently evaluates and recommends products and services based on their research and expertise. Learn more about our process and partners here .

6 Elements of a Successful Financial Plan for a Small Business

Improve your chances of growth by covering these bases in your plan.

Table of Contents

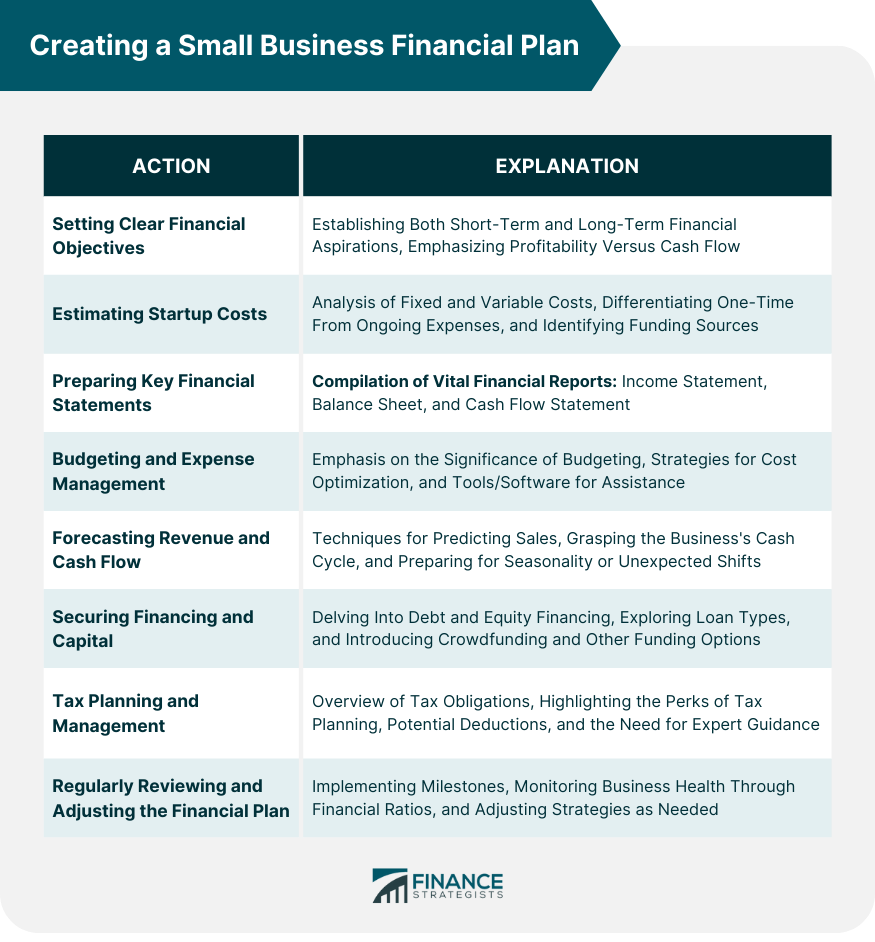

Many small businesses lack a full financial plan, even though evidence shows that it is essential to the long-term success and growth of any business.

For example, a study in the New England Journal of Entrepreneurship found that entrepreneurs with a business plan are more successful than those without one. If you’re not sure how to get started, read on to learn the six key elements of a successful small business financial plan.

What is a business financial plan, and why is it important?

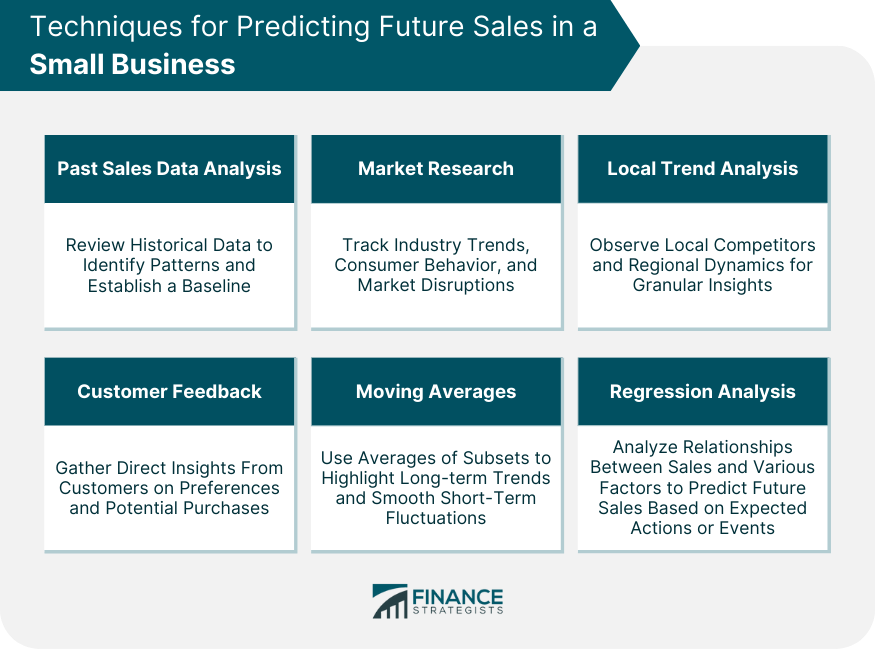

A business financial plan is an overview of a business’s financial situation and a forward-looking projection for growth. A business financial plan typically has six parts: sales forecasting, expense outlay, a statement of financial position, a cash flow projection, a break-even analysis and an operations plan.

A good financial plan helps you manage cash flow and accounts for months when revenue might be lower than expected. It also helps you budget for daily and monthly expenses and plan for taxes each year.

Importantly, a financial plan helps you focus on the long-term growth of your business. That way, you don’t get so caught up in the day-to-day activities that you lose sight of your goals. Focusing on the long-term vision helps you prioritize your financial resources.

The 6 components of a successful financial plan for business

1. sales forecasting.

You should have an estimate of your sales revenue for every month, quarter and year. Identifying any patterns in your sales cycles helps you better understand your business, and this knowledge is invaluable as you plan marketing initiatives and growth strategies .

For instance, a seasonal business can aim to improve sales in the off-season to eventually become a year-round venture. Another business might become better prepared by understanding how upticks and downturns in business relate to factors such as the weather or the economy.

Sales forecasting is also the foundation for setting company growth goals. For instance, you could aim to improve your sales by 10 percent over each previous period.

2. Expense outlay

A full expense plan includes regular expenses, expected future expenses and associated expenses. Regular expenses are the current ongoing costs of your business, including operational costs such as rent, utilities and payroll.

Regular expenses relate to standard business activities that occur each year, such as conference attendance, advertising and marketing, and the office holiday party. It’s a good idea to distinguish essential expenses from expenses that can be reduced or eliminated if needed.

Expected future expenses are known future costs, such as tax rate increases, minimum wage increases or maintenance needs. Generally, a part of the budget should also be allocated to unexpected future expenses, such as damage to your business caused by fire, flood or other unexpected disasters. Planning for future expenses ensures your business is financially prepared via budget reduction, increases in sales or financial assistance.

Associated expenses are the estimated costs of various initiatives, such as acquiring and training new hires, opening a new store or expanding delivery to a new territory. An accurate estimate of associated expenses helps you properly manage growth and prevents your business from exceeding your cost capabilities.

As with expected future expenses, understanding how much capital is required to accomplish various growth goals helps you make the right decision about financing options.

3. Statement of financial position (assets and liabilities)

Assets and liabilities are the foundation of your business’s balance sheet and the primary determinants of your business’s net worth. Tracking both allows you to maximize your business’s potential value.

Small businesses frequently undervalue their assets (such as machinery, property or inventory) and fail to properly account for outstanding bills. Your balance sheet offers a more complete view of your business’s health than a profit-and-loss statement or a cash flow report.

A profit-and-loss statement shows how the business performed over a specific time period, while a balance sheet shows the financial position of the business on any given day.

4. Cash flow projection

You should be able to predict your cash flow on a monthly, quarterly and annual basis. Projecting cash flow for the full year allows you to get ahead of any financial struggles or challenges.

It can also help you identify a cash flow problem before it hurts your business. You can set the most appropriate payment terms, such as how much you charge upfront or how many days after invoicing you expect payment .

A cash flow projection gives you a clear look at how much money is expected to be left at the end of each month so you can plan a possible expansion or other investments. It also helps you budget, such as by spending less one month for the anticipated cash needs of another month.

5. Break-even analysis

A break-even analysis evaluates fixed costs relative to the profit earned by each additional unit you produce and sell. This analysis is essential to understanding your business’s revenue and potential costs versus profits of expansion or growth of your output.

Having your expenses fully fleshed out, as described above, makes your break-even analysis more accurate and useful. A break-even analysis is also the best way to determine your pricing.

In addition, a break-even analysis can tell you how many units you need to sell at various prices to cover your costs. You should aim to set a price that gives you a comfortable margin over your expenses while allowing your business to remain competitive.

6. Operations plan

To run your business as efficiently as possible, craft a detailed overview of your operational needs. Understanding what roles are required for you to operate your business at various volumes of output, how much output or work each employee can handle, and the costs of each stage of your supply chain will aid you in making informed decisions for your business’s growth and efficiency.

It’s important to tightly control expenses, such as payroll or supply chain costs, relative to growth. An operations plan can also make it easier to determine if there is room to optimize your operations or supply chain via automation, new technology or superior supply chain vendors.

For this reason, it is imperative for a business owner to conduct due diligence and become knowledgeable about merchant services before acquiring an account. Once the owner signs a contract, it cannot be changed, unless the business owner breaks the contract and acquires a new account with a new merchant services provider.

Tips on writing a business financial plan

Business owners should create a financial plan annually to ensure they have a clear and accurate picture of their business’s finances and a realistic view for future growth or expansion. A financial plan helps the business’s leaders make informed decisions about purchases, debt, hiring, expense control and overall operations for the year ahead.

A business financial plan is essential if a business owner is looking to sell their business, attract investors or enter a partnership with another business. Here are some tips for writing a business financial plan.

Review the previous year’s plan.

It’s a good idea to compare the previous year’s plan against actual performance and finances to see how accurate the previous plan and forecast were. That way, you can address any discrepancies or overlooked elements in next year’s plan.

Collaborate with other departments.

A business owner or other individual charged with creating the business financial plan should collaborate with the finance department, human resources department, sales team , operations leader, and those in charge of machinery, vehicles or other significant business tools.

Each division should provide the necessary data about projections, value and expenses. All of these elements come together to create a comprehensive financial picture of the business.

Use available resources.

The Small Business Administration (SBA) and SCORE, the SBA’s nonprofit partner, are two excellent resources for learning about financial plans. Both can teach you the elements of a comprehensive plan and how best to work with the different departments in your business to collect the necessary information. Many websites, including business.com , and service providers, such as Intuit, offer advice on this matter.

If you have questions or encounter challenges while creating your business financial plan, seek advice from your accountant or other small business owners in your network. Your city or state has a small business office that you can contact for help.

Business financial plan templates

Many business organizations offer free information that small business owners can use to create their financial plan. For example, the SBA’s Learning Platform offers a course on how to create a business plan. It also offers worksheets and templates to help you get started. You can seek additional help and more personalized service from your local office.

SCORE is the largest volunteer network of business mentors. It began as a group of retired executives (SCORE stands for “Service Corps of Retired Executives”) but has expanded to include business owners and executives from many industries. Advice is free and available online, and there are SBA district offices in every U.S. state. In addition to participating in group or at-home learning, you can be paired with a mentor for individualized help.

SCORE offers templates and tips for creating a small business financial plan. SCORE is an excellent resource because it addresses different levels of experience and offers individualized help.

Other templates can be found in Microsoft Office’s template library, QuickBooks’ online resources, Shopify’s blog and other places. You can also ask your accountant for guidance, since many accountants provide financial planning services in addition to their usual tax services.

Diana Wertz contributed to the writing and research in this article.

Get Weekly 5-Minute Business Advice

B. newsletter is your digest of bite-sized news, thought & brand leadership, and entertainment. All in one email.

Our mission is to help you take your team, your business and your career to the next level. Whether you're here for product recommendations, research or career advice, we're happy you're here!

AI ASSISTANTS

Upmetrics AI Your go-to AI-powered business assistant

AI Writing Assist Write, translate, and refine your text with AI

AI Financial Assist Automated forecasts and AI recommendations

TOP FEATURES

AI Business Plan Generator Create business plans faster with AI

Financial Forecasting Make accurate financial forecasts faster

INTEGRATIONS

QuickBooks Sync and compare with your QuickBooks data

Strategic Planning Develop actionable strategic plans on-the-go

AI Pitch Deck Generator Use AI to generate your investor deck

Xero Sync and compare with your Xero data

See how easy it is to plan your business with Upmetrics: Take a Tour →

AI-powered business planning software

Very useful business plan software connected to AI. Saved a lot of time, money and energy. Their team is highly skilled and always here to help.

- Julien López

BY USE CASE

Secure Funding, Loans, Grants Create plans that get you funded

Starting & Launching a Business Plan your business for launch and success

Validate Your Business Idea Discover the potential of your business idea

E2 Visa Business Plan Create a business plan to support your E2 - Visa

Business Consultant & Advisors Plan with your team members and clients

Incubators & Accelerators Empowering startups for growth

Business Schools & Educators Simplify business plan education for students

Students & Learners Your e-tutor for business planning

- Sample Plans

WHY UPMETRICS?

Reviews See why customers love Upmetrics

Customer Success Stories Read our customer success stories

Blogs Latest business planning tips and strategies

Strategic Planning Templates Ready-to-use strategic plan templates

Business Plan Course A step-by-step business planning course

Help Center Help & guides to plan your business

Ebooks & Guides A free resource hub on business planning

Business Tools Free business tools to help you grow

How to Prepare a Financial Plan for Startup Business (w/ example)

Free Financial Statements Template

Ajay Jagtap

- December 7, 2023

- 13 Min Read

If someone were to ask you about your business financials, could you give them a detailed answer?

Let’s say they ask—how do you allocate your operating expenses? What is your cash flow situation like? What is your exit strategy? And a series of similar other questions.

Instead of mumbling what to answer or shooting in the dark, as a founder, you must prepare yourself to answer this line of questioning—and creating a financial plan for your startup is the best way to do it.

A business plan’s financial plan section is no easy task—we get that.

But, you know what—this in-depth guide and financial plan example can make forecasting as simple as counting on your fingertips.

Ready to get started? Let’s begin by discussing startup financial planning.

What is Startup Financial Planning?

Startup financial planning, in simple terms, is a process of planning the financial aspects of a new business. It’s an integral part of a business plan and comprises its three major components: balance sheet, income statement, and cash-flow statement.

Apart from these statements, your financial section may also include revenue and sales forecasts, assets & liabilities, break-even analysis , and more. Your first financial plan may not be very detailed, but you can tweak and update it as your company grows.

Key Takeaways

- Realistic assumptions, thorough research, and a clear understanding of the market are the key to reliable financial projections.

- Cash flow projection, balance sheet, and income statement are three major components of a financial plan.

- Preparing a financial plan is easier and faster when you use a financial planning tool.

- Exploring “what-if” scenarios is an ideal method to understand the potential risks and opportunities involved in the business operations.

Why is Financial Planning Important to Your Startup?

Poor financial planning is one of the biggest reasons why most startups fail. In fact, a recent CNBC study reported that running out of cash was the reason behind 44% of startup failures in 2022.

A well-prepared financial plan provides a clear financial direction for your business, helps you set realistic financial objectives, create accurate forecasts, and shows your business is committed to its financial objectives.

It’s a key element of your business plan for winning potential investors. In fact, YC considered recent financial statements and projections to be critical elements of their Series A due diligence checklist .

Your financial plan demonstrates how your business manages expenses and generates revenue and helps them understand where your business stands today and in 5 years.

Makes sense why financial planning is important to your startup or small business, doesn’t it? Let’s cut to the chase and discuss the key components of a startup’s financial plan.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $7/month

Key Components of a Startup Financial Plan

Whether creating a financial plan from scratch for a business venture or just modifying it for an existing one, here are the key components to consider including in your startup’s financial planning process.

Income Statement

An Income statement , also known as a profit-and-loss statement(P&L), shows your company’s income and expenditures. It also demonstrates how your business experienced any profit or loss over a given time.

Consider it as a snapshot of your business that shows the feasibility of your business idea. An income statement can be generated considering three scenarios: worst, expected, and best.

Your income or P&L statement must list the following:

- Cost of goods or cost of sale

- Gross margin

- Operating expenses

- Revenue streams

- EBITDA (Earnings before interest, tax, depreciation , & amortization )

Established businesses can prepare annual income statements, whereas new businesses and startups should consider preparing monthly statements.

Cash flow Statement

A cash flow statement is one of the most critical financial statements for startups that summarize your business’s cash in-and-out flows over a given time.

This section provides details on the cash position of your business and its ability to meet monetary commitments on a timely basis.

Your cash flow projection consists of the following three components:

✅ Cash revenue projection: Here, you must enter each month’s estimated or expected sales figures.

✅ Cash disbursements: List expenditures that you expect to pay in cash for each month over one year.

✅ Cash flow reconciliation: Cash flow reconciliation is a process used to ensure the accuracy of cash flow projections. The adjusted amount is the cash flow balance carried over to the next month.

Furthermore, a company’s cash flow projections can be crucial while assessing liquidity, its ability to generate positive cash flows and pay off debts, and invest in growth initiatives.

Balance Sheet

Your balance sheet is a financial statement that reports your company’s assets, liabilities, and shareholder equity at a given time.

Consider it as a snapshot of what your business owns and owes, as well as the amount invested by the shareholders.

This statement consists of three parts: assets , liabilities, and the balance calculated by the difference between the first two. The final numbers on this sheet reflect the business owner’s equity or value.

Balance sheets follow the following accounting equation with assets on one side and liabilities plus Owner’s equity on the other:

Here is what’s the core purpose of having a balance-sheet:

- Indicates the capital need of the business

- It helps to identify the allocation of resources

- It calculates the requirement of seed money you put up, and

- How much finance is required?

Since it helps investors understand the condition of your business on a given date, it’s a financial statement you can’t miss out on.

Break-even Analysis

Break-even analysis is a startup or small business accounting practice used to determine when a company, product, or service will become profitable.

For instance, a break-even analysis could help you understand how many candles you need to sell to cover your warehousing and manufacturing costs and start making profits.

Remember, anything you sell beyond the break-even point will result in profit.

You must be aware of your fixed and variable costs to accurately determine your startup’s break-even point.

- Fixed costs: fixed expenses that stay the same no matter what.

- Variable costs: expenses that fluctuate over time depending on production or sales.

A break-even point helps you smartly price your goods or services, cover fixed costs, catch missing expenses, and set sales targets while helping investors gain confidence in your business. No brainer—why it’s a key component of your startup’s financial plan.

Having covered all the key elements of a financial plan, let’s discuss how you can create a financial plan for your startup or small business.

How to Create a Financial Section of a Startup Business Plan?

1. determine your financial needs.

You can’t start financial planning without understanding your financial requirements, can you? Get your notepad or simply open a notion doc; it’s time for some critical thinking.

Start by assessing your current situation by—calculating your income, expenses , assets, and liabilities, what the startup costs are, how much you have against them, and how much financing you need.

Assessing your current financial situation and health will help determine how much capital you need for your small business and help plan fundraising activities and outreach.

Furthermore, determining financial needs helps prioritize operational activities and expenses, effectively allocate resources, and increase the viability and sustainability of a business in the long run.

Having learned to determine financial needs, let’s head straight to setting financial goals.

2. Define Your Financial Goals

Setting realistic financial goals is fundamental in preparing an effective financial plan for your business plan. So, it would help to outline your long-term strategies and goals at the beginning of your financial planning process.

Let’s understand it this way—if you are a SaaS startup pursuing VC financing rounds, you may ask investors about what matters to them the most and prepare your financial plan accordingly.

However, a coffee shop owner seeking a business loan may need to create a plan that appeals to banks, not investors. At the same time, an internal financial plan designed to offer financial direction and resource allocation may not be the same as previous examples, seeing its different use case.

Feeling overwhelmed? Just define your financial goals—you’ll be fine.

You can start by identifying your business KPIs (key performance indicators); it would be an ideal starting point.

3. Choose the Right Financial Planning Tool

Let’s face it—preparing a financial plan using Excel is no joke. One would only use this method if they had all the time in the world.

Having the right financial planning software will simplify and speed up the process and guide you through creating accurate financial forecasts.

Many financial planning software and tools claim to be the ideal solution, but it’s you who will identify and choose a tool that is best for your financial planning needs.

Create a Financial Plan with Upmetrics in no time

Enter your Financial Assumptions, and we’ll calculate your monthly/quarterly and yearly financial projections.

Start Forecasting

4. Make Assumptions Before Projecting Financials

Once you have a financial planning tool, you can move forward to the next step— making financial assumptions for your plan based on your company’s current performance and past financial records.

You’re just making predictions about your company’s financial future, so there’s no need to overthink or complicate the process.

You can gather your business’ historical financial data, market trends, and other relevant documents to help create a base for accurate financial projections.

After you have developed rough assumptions and a good understanding of your business finances, you can move forward to the next step—projecting financials.

5. Prepare Realistic Financial Projections

It’s a no-brainer—financial forecasting is the most critical yet challenging aspect of financial planning. However, it’s effortless if you’re using a financial planning software.

Upmetrics’ forecasting feature can help you project financials for up to 7 years. However, new startups usually consider planning for the next five years. Although it can be contradictory considering your financial goals and investor specifications.

Following are the two key aspects of your financial projections:

Revenue Projections

In simple terms, revenue projections help investors determine how much revenue your business plans to generate in years to come.

It generally involves conducting market research, determining pricing strategy , and cash flow analysis—which we’ve already discussed in the previous steps.

The following are the key components of an accurate revenue projection report:

- Market analysis

- Sales forecast

- Pricing strategy

- Growth assumptions

- Seasonal variations

This is a critical section for pre-revenue startups, so ensure your projections accurately align with your startup’s financial model and revenue goals.

Expense Projections

Both revenue and expense projections are correlated to each other. As revenue forecasts projected revenue assumptions, expense projections will estimate expenses associated with operating your business.

Accurately estimating your expenses will help in effective cash flow analysis and proper resource allocation.

These are the most common costs to consider while projecting expenses:

- Fixed costs

- Variable costs

- Employee costs or payroll expenses

- Operational expenses

- Marketing and advertising expenses

- Emergency fund

Remember, realistic assumptions, thorough research, and a clear understanding of your market are the key to reliable financial projections.

6. Consider “What if” Scenarios

After you project your financials, it’s time to test your assumptions with what-if analysis, also known as sensitivity analysis.

Using what-if analysis with different scenarios while projecting your financials will increase transparency and help investors better understand your startup’s future with its best, expected, and worst-case scenarios.

Exploring “what-if” scenarios is the best way to better understand the potential risks and opportunities involved in business operations. This proactive exercise will help you make strategic decisions and necessary adjustments to your financial plan.

7. Build a Visual Report

If you’ve closely followed the steps leading to this, you know how to research for financial projections, create a financial plan, and test assumptions using “what-if” scenarios.

Now, we’ll prepare visual reports to present your numbers in a visually appealing and easily digestible format.

Don’t worry—it’s no extra effort. You’ve already made a visual report while creating your financial plan and forecasting financials.

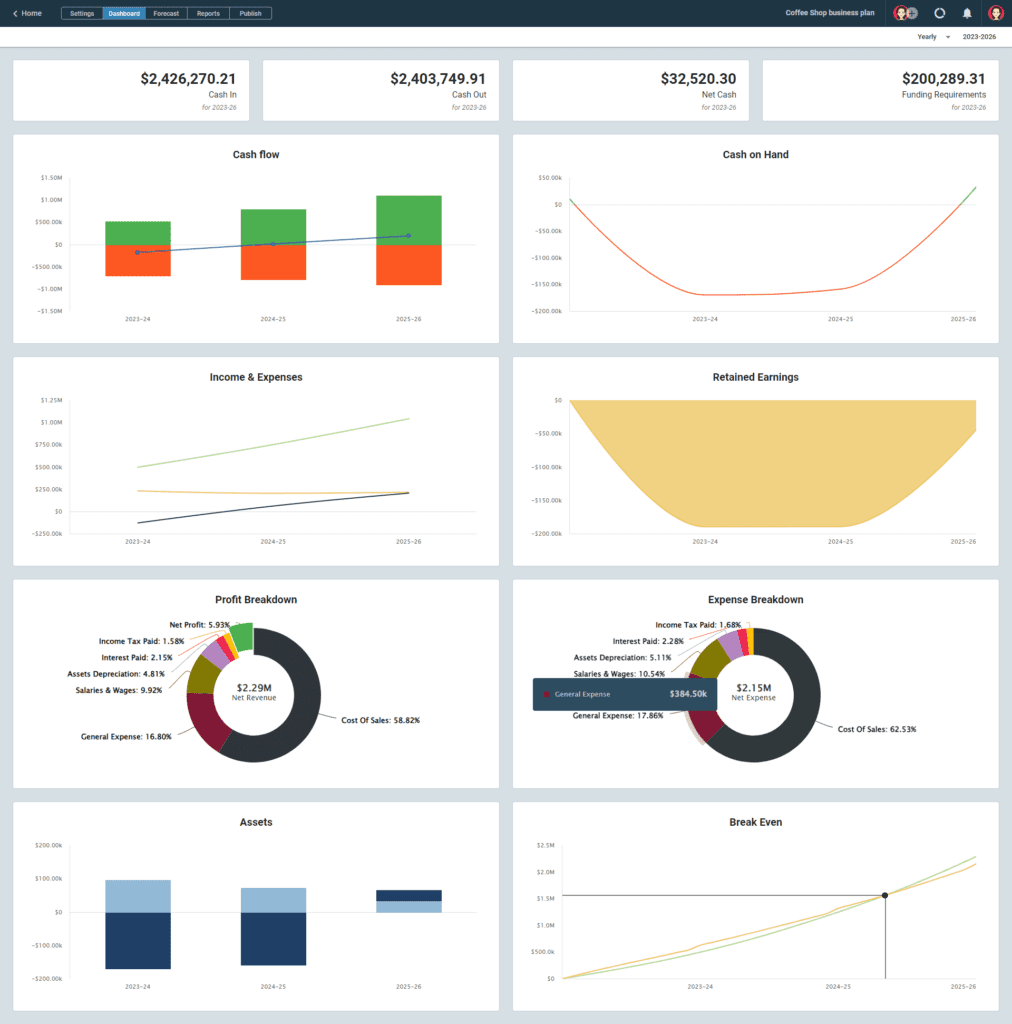

Check the dashboard to see the visual presentation of your projections and reports, and use the necessary financial data, diagrams, and graphs in the final draft of your financial plan.

Here’s what Upmetrics’ dashboard looks like:

8. Monitor and Adjust Your Financial Plan

Even though it’s not a primary step in creating a good financial plan for your small business, it’s quite essential to regularly monitor and adjust your financial plan to ensure the assumptions you made are still relevant, and you are heading in the right direction.

There are multiple ways to monitor your financial plan.

For instance, you can compare your assumptions with actual results to ensure accurate projections based on metrics like new customers acquired and acquisition costs, net profit, and gross margin.

Consider making necessary adjustments if your assumptions are not resonating with actual numbers.

Also, keep an eye on whether the changes you’ve identified are having the desired effect by monitoring their implementation.

And that was the last step in our financial planning guide. However, it’s not the end. Have a look at this financial plan example.

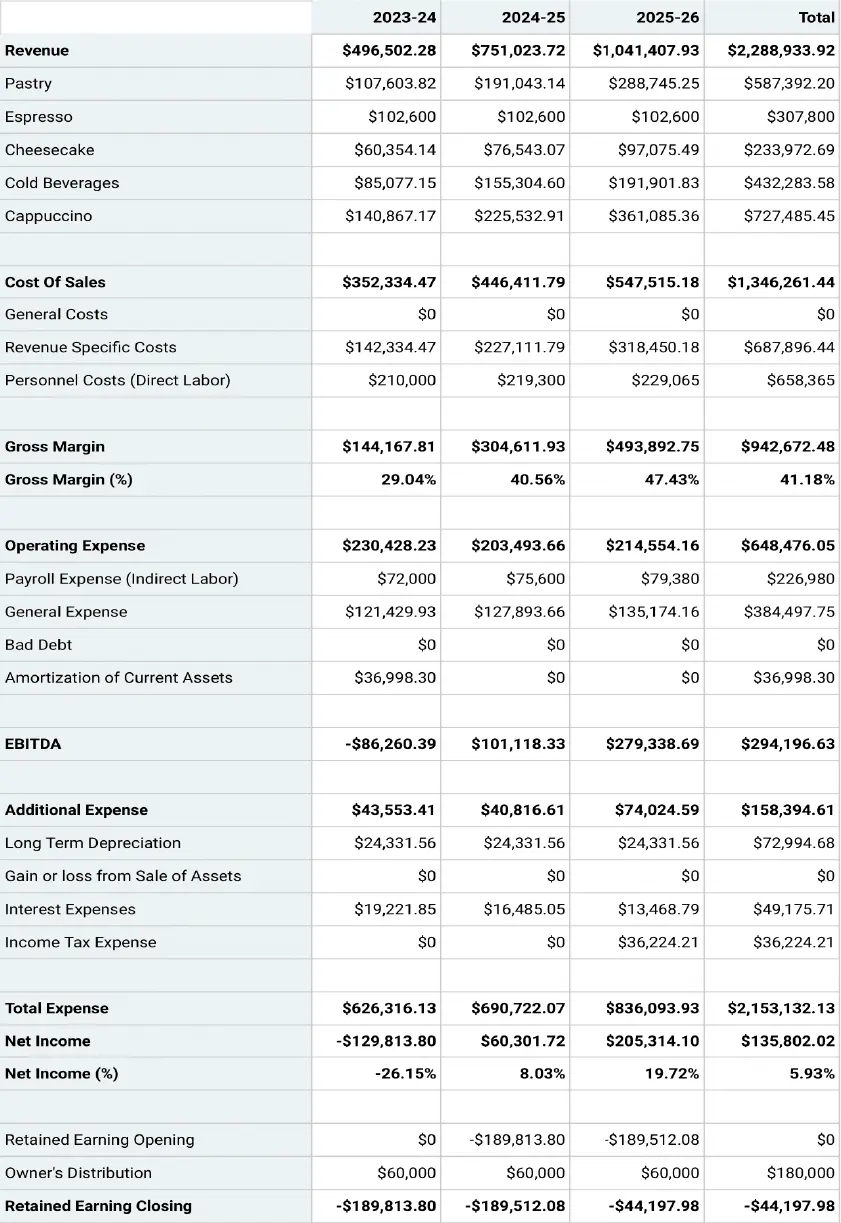

Startup Financial Plan Example

Having learned about financial planning, let’s quickly discuss a coffee shop startup financial plan example prepared using Upmetrics.

Important Assumptions

- The sales forecast is conservative and assumes a 5% increase in Year 2 and a 10% in Year 3.

- The analysis accounts for economic seasonality – wherein some months revenues peak (such as holidays ) and wanes in slower months.

- The analysis assumes the owner will not withdraw any salary till the 3rd year; at any time it is assumed that the owner’s withdrawal is available at his discretion.

- Sales are cash basis – nonaccrual accounting

- Moderate ramp- up in staff over the 5 years forecast

- Barista salary in the forecast is $36,000 in 2023.

- In general, most cafes have an 85% gross profit margin

- In general, most cafes have a 3% net profit margin

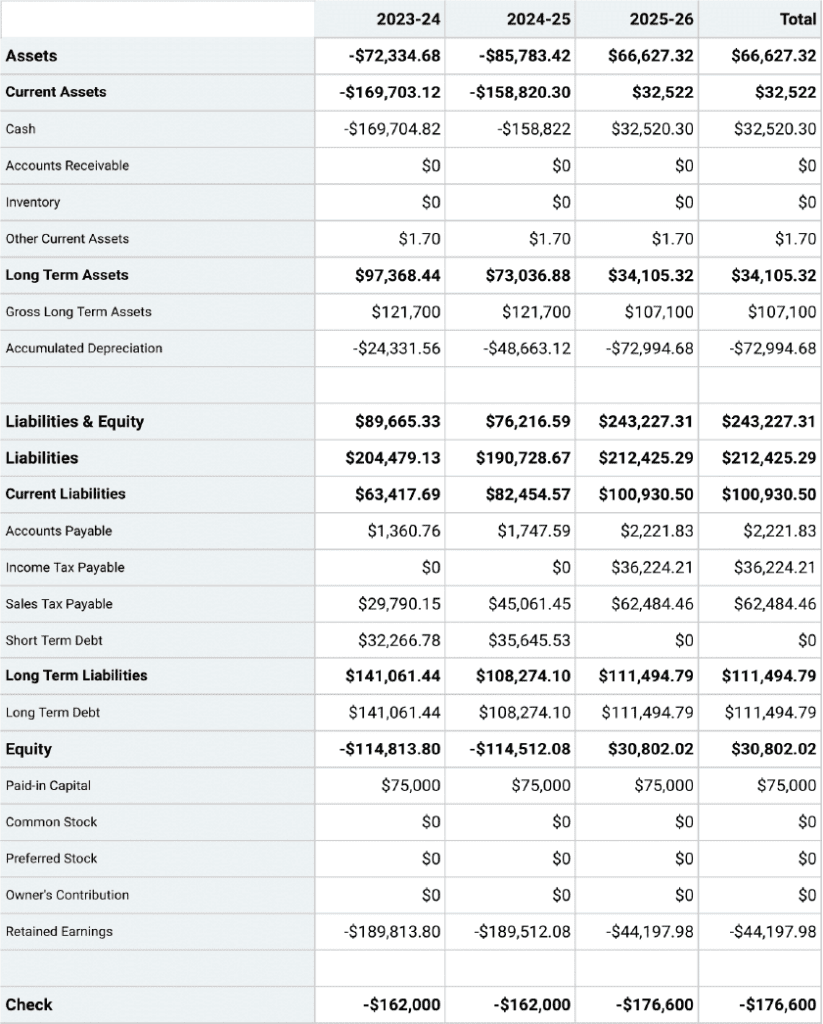

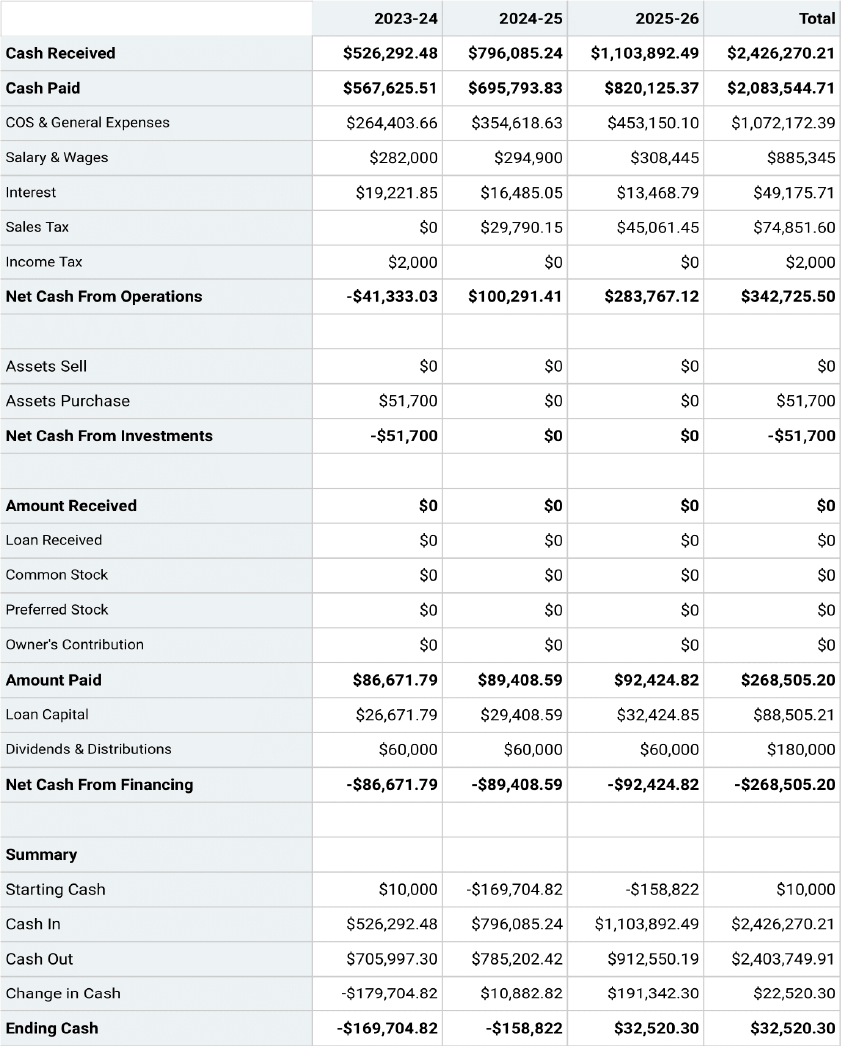

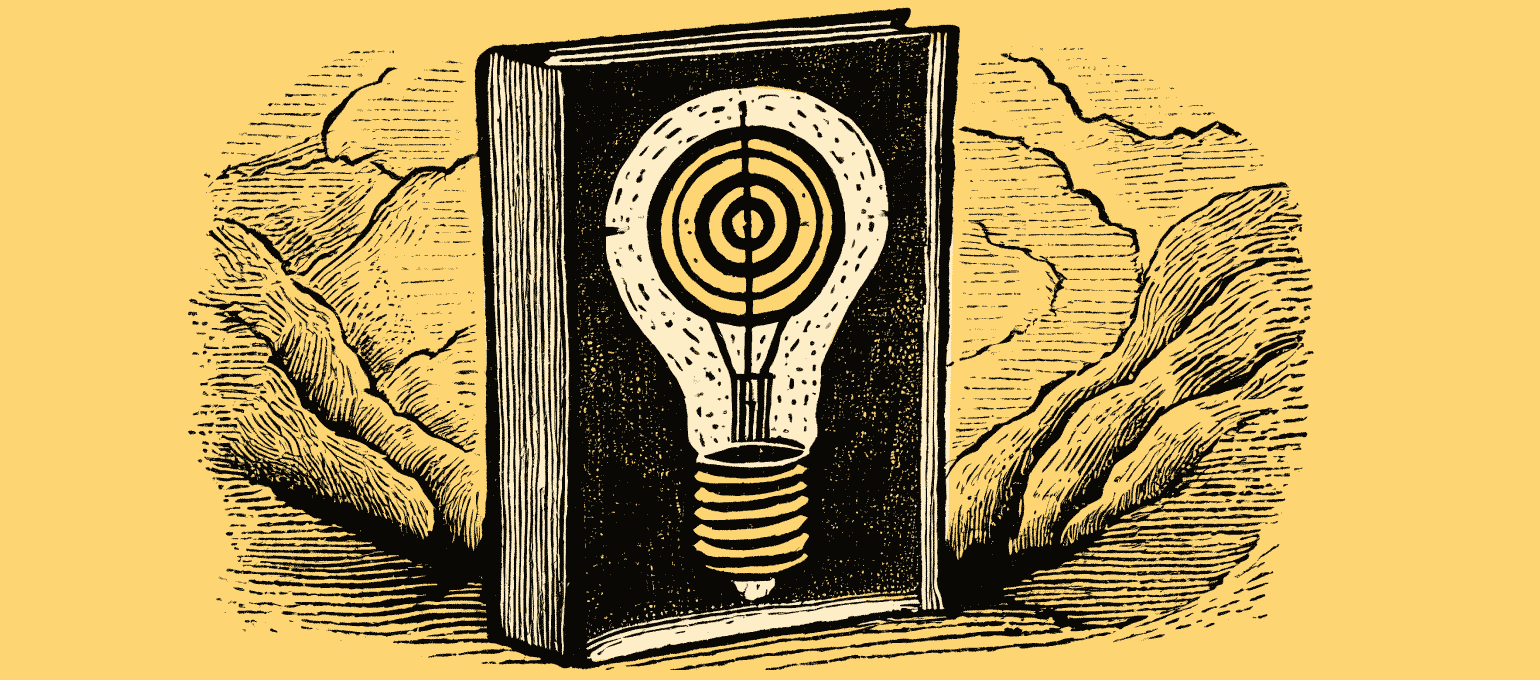

Projected Balance Sheet

Projected Cash-Flow Statement

Projected Profit & Loss Statement

Break Even Analysis

Start Preparing Your Financial Plan

We covered everything about financial planning in this guide, didn’t we? Although it doesn’t fulfill our objective to the fullest—we want you to finish your financial plan.

Sounds like a tough job? We have an easy way out for you—Upmetrics’ financial forecasting feature. Simply enter your financial assumptions, and let it do the rest.

So what are you waiting for? Try Upmetrics and create your financial plan in a snap.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

How often should i update my financial projections.

Well, there is no particular rule about it. However, reviewing and updating your financial plan once a year is considered an ideal practice as it ensures that the financial aspirations you started and the projections you made are still relevant.

How do I estimate startup costs accurately?

You can estimate your startup costs by identifying and factoring various one-time, recurring, and hidden expenses. However, using a financial forecasting tool like Upmetrics will ensure accurate costs while speeding up the process.

What financial ratios should startups pay attention to?

Here’s a list of financial ratios every startup owner should keep an eye on:

- Net profit margin

- Current ratio

- Quick ratio

- Working capital

- Return on equity

- Debt-to-equity ratio

- Return on assets

- Debt-to-asset ratio

What are the 3 different scenarios in scenario analysis?

As discussed earlier, Scenario analysis is the process of ascertaining and analyzing possible events that can occur in the future. Startups or small businesses often consider analyzing these three scenarios:

- base-case (expected) scenario

- Worst-case scenario

- best case scenario.

About the Author

Ajay is a SaaS writer and personal finance blogger who has been active in the space for over three years, writing about startups, business planning, budgeting, credit cards, and other topics related to personal finance. If not writing, he’s probably having a power nap. Read more

Reach Your Goals with Accurate Planning

How to Write a Financial Plan for a Business Plan

Noah Parsons

4 min. read

Updated July 11, 2024

Creating a financial plan for a business plan is often the most intimidating part for small business owners.

It’s also one of the most vital. Businesses with well-structured and accurate financial statements are more prepared to pitch to investors, receive funding, and achieve long-term success.

Thankfully, you don’t need an accounting degree to successfully create your budget and forecasts.

Here is everything you need to include in your business plan’s financial plan, along with optional performance metrics, funding specifics, mistakes to avoid , and free templates.

- Key components of a financial plan in business plans

A sound financial plan for a business plan is made up of six key components that help you easily track and forecast your business financials. They include your:

Sales forecast

What do you expect to sell in a given period? Segment and organize your sales projections with a personalized sales forecast based on your business type.

Subscription sales forecast

While not too different from traditional sales forecasts—there are a few specific terms and calculations you’ll need to know when forecasting sales for a subscription-based business.

Expense budget

Create, review, and revise your expense budget to keep your business on track and more easily predict future expenses.

How to forecast personnel costs

How much do your current, and future, employees’ pay, taxes, and benefits cost your business? Find out by forecasting your personnel costs.

Profit and loss forecast

Track how you make money and how much you spend by listing all of your revenue streams and expenses in your profit and loss statement.

Cash flow forecast

Manage and create projections for the inflow and outflow of cash by building a cash flow statement and forecast.

Balance sheet

Need a snapshot of your business’s financial position? Keep an eye on your assets, liabilities, and equity within the balance sheet.

What to include if you plan to pursue funding

Do you plan to pursue any form of funding or financing? If the answer is yes, you’ll need to include a few additional pieces of information as part of your business plan’s financial plan example.

Highlight any risks and assumptions

Every entrepreneur takes risks with the biggest being assumptions and guesses about the future. Just be sure to track and address these unknowns in your plan early on.

Plan your exit strategy

Investors will want to know your long-term plans as a business owner. While you don’t need to have all the details, it’s worth taking the time to think through how you eventually plan to leave your business.

- Financial ratios and metrics

With your financial statements and forecasts in place, you have all the numbers needed to calculate insightful financial ratios.

While including these metrics in your financial plan for a business plan is entirely optional, having them easily accessible can be valuable for tracking your performance and overall financial situation.

Key financial terms you should know

It’s not hard. Anybody who can run a business can understand these key financial terms. And every business owner and entrepreneur should know them.

Common business ratios

Unsure of which business ratios you should be using? Check out this list of key financial ratios that bankers, financial analysts, and investors will want to see.

Break-even analysis

Do you want to know when you’ll become profitable? Find out how much you need to sell to offset your production costs by conducting a break-even analysis.

How to calculate ROI

How much could a business decision be worth? Evaluate the efficiency or profitability by calculating the potential return on investment (ROI).

- How to improve your financial plan

Your financial statements are the core part of your business plan’s financial plan that you’ll revisit most often. Instead of worrying about getting it perfect the first time, check out the following resources to learn how to improve your projections over time.

Common mistakes with business forecasts

I was glad to be asked about common mistakes with startup financial projections. I read about 100 business plans per year, and I have this list of mistakes.

How to improve your financial projections

Learn how to improve your business financial projections by following these five basic guidelines.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- Financial plan templates and tools

Download and use these free financial templates and calculators to easily create your own financial plan.

Sales forecast template

Download a free detailed sales forecast spreadsheet, with built-in formulas, to easily estimate your first full year of monthly sales.

Download Template

Accurate and easy financial forecasting

Get a full financial picture of your business with LivePlan's simple financial management tools.

Get Started

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- What to include for funding

Related Articles

10 Min. Read

How to Write a Competitive Analysis for Your Business Plan

6 Min. Read

How to Write Your Business Plan Cover Page + Template

How to Write the Company Overview for a Business Plan

3 Min. Read

What to Include in Your Business Plan Appendix

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Business Financial Plan Example: Strategies and Best Practices

Any successful endeavor begins with a robust plan – and running a prosperous business is no exception. Careful strategic planning acts as the bedrock on which companies build their future. One of the most critical aspects of this strategic planning is the creation of a detailed business financial plan. This plan serves as a guide, helping businesses navigate their way through the complex world of finance, including revenue projection, cost estimation, and capital expenditure, to name just a few elements. However, understanding what a business financial plan entails and how to implement it effectively can often be challenging. With multiple components to consider and various economic factors at play, the financial planning process may appear daunting to both new and established business owners.

This is where we come in. In this comprehensive article, we delve into the specifics of a business financial plan. We discuss its importance, the essential elements that make it up, and the steps to craft one successfully. Furthermore, we provide a practical example of a business financial plan in action, drawing upon real-world-like scenarios and strategies. By presenting the best practices and demonstrating how to employ them, we aim to equip business owners and entrepreneurs with the tools they need to create a robust, realistic, and efficient business financial plan. This in-depth guide will help you understand not only how to plan your business finances but also how to use this plan as a roadmap, leading your business towards growth, profitability, and overall financial success. Whether you're a seasoned business owner aiming to refine your financial strategies or an aspiring entrepreneur at the beginning of your journey, this article is designed to guide you through the intricacies of business financial planning and shed light on the strategies that can help your business thrive.

Understanding a Business Financial Plan

At its core, a business financial plan is a strategic blueprint that sets forth how a company will manage and navigate its financial operations, guiding the organization towards its defined fiscal objectives. It encompasses several critical aspects of a business's financial management, such as revenue projection, cost estimation, capital expenditure, cash flow management, and investment strategies.

Revenue projection is an estimate of the revenue a business expects to generate within a specific period. It's often based on market research, historical data, and educated assumptions about future market trends. Cost estimation, on the other hand, involves outlining the expenses a business anticipates incurring in its operations. Together, revenue projection and cost estimation can give a clear picture of a company's expected profitability. Capital expenditure refers to the funds a company allocates towards the purchase or maintenance of long-term assets like machinery, buildings, and equipment. Understanding capital expenditure is vital as it can significantly impact a business's operational capacity and future profitability. The cash flow management aspect of a business financial plan involves monitoring, analyzing, and optimizing the company's cash inflows and outflows. A healthy cash flow ensures that a business can meet its short-term obligations, invest in its growth, and provide a buffer for future uncertainties. Lastly, a company's investment strategies are crucial for its growth and sustainability. They might include strategies for raising capital, such as issuing shares or securing loans, or strategies for investing surplus cash, like purchasing assets or investing in market securities.

A well-developed business financial plan, therefore, doesn't just portray the company's current financial status; it also serves as a roadmap for the business's fiscal operations, enabling it to navigate towards its financial goals. The plan acts as a guide, providing insights that help business owners make informed decisions, whether they're about day-to-day operations or long-term strategic choices. In a nutshell, a business financial plan is a key tool in managing a company's financial resources effectively and strategically. It allows businesses to plan for growth, prepare for uncertainties, and strive for financial sustainability and success.

Essential Elements of a Business Financial Plan

A comprehensive financial plan contains several crucial elements, including:

- Sales Forecast : The sales forecast represents the business's projected sales revenues. It is often broken down into segments such as products, services, or regions.

- Expenses Budget : This portion of the plan outlines the anticipated costs of running the business. It includes fixed costs (rent, salaries) and variable costs (marketing, production).

- Cash Flow Statement : This statement records the cash that comes in and goes out of a business, effectively portraying its liquidity.

- Income Statements : Also known as profit and loss statements, income statements provide an overview of the business's profitability over a given period.

- Balance Sheet : This snapshot of a company's financial health shows its assets, liabilities, and equity.

Crafting a Business Financial Plan: The Steps

Developing a business financial plan requires careful analysis and planning. Here are the steps involved:

Step 1: Set Clear Financial Goals

The initial stage in crafting a robust business financial plan involves the establishment of clear, measurable financial goals. These objectives serve as your business's financial targets and compass, guiding your company's financial strategy. These goals can be short-term, such as improving quarterly sales or reducing monthly overhead costs, or they can be long-term, such as expanding the business to a new location within five years or doubling the annual revenue within three years. The goals might include specific targets such as increasing revenue by a particular percentage, reducing costs by a specific amount, or achieving a certain profit margin. Setting clear goals provides a target to aim for and allows you to measure your progress over time.

Step 2: Create a Sales Forecast

The cornerstone of any business financial plan is a robust sales forecast. This element of the plan involves predicting the sales your business will make over a given period. This estimate should be based on comprehensive market research, historical sales data, an understanding of industry trends, and the impact of any marketing or promotional activities. Consider the business's growth rate, the overall market size, and seasonal fluctuations in demand. Remember, your sales forecast directly influences the rest of your financial plan, particularly your budgets for expenses and cash flow, so it's critical to make it as accurate and realistic as possible.

Step 3: Prepare an Expense Budget

The next step involves preparing a comprehensive expense budget that covers all the costs your business is likely to incur. This includes fixed costs, such as rent or mortgage payments, salaries, insurance, and other overheads that remain relatively constant regardless of your business's level of output. It also includes variable costs, such as raw materials, inventory, marketing and advertising expenses, and other costs that fluctuate in direct proportion to the level of goods or services you produce. By understanding your expense budget, you can determine how much revenue your business needs to generate to cover costs and become profitable.

Step 4: Develop a Cash Flow Statement

One of the most crucial elements of your financial plan is the cash flow statement. This document records all the cash that enters and leaves your business, presenting a clear picture of your company's liquidity. Regularly updating your cash flow statement allows you to monitor the cash in hand and foresee any potential shortfalls. It helps you understand when cash comes into your business from sales and when cash goes out of your business due to expenses, giving you insights into your financial peaks and troughs and enabling you to manage your cash resources more effectively.

Step 5: Prepare Income Statements and Balance Sheets

Another vital part of your business financial plan includes the preparation of income statements and balance sheets. An income statement, also known as a Profit & Loss (P&L) statement, provides an overview of your business's profitability over a certain period. It subtracts the total expenses from total revenue to calculate net income, providing valuable insights into the profitability of your operations.

On the other hand, the balance sheet provides a snapshot of your company's financial health at a specific point in time. It lists your company's assets (what the company owns), liabilities (what the company owes), and equity (the owner's or shareholders' investment in the business). These documents help you understand where your business stands financially, whether it's making a profit, and how your assets, liabilities, and equity balance out.

Step 6: Revise Your Plan Regularly

It's important to remember that a financial plan is not a static document, but rather a living, evolving roadmap that should adapt to your business's changing circumstances and market conditions. As such, regular reviews and updates are crucial. By continually revisiting and revising your plan, you can ensure it remains accurate, relevant, and effective. You can adjust your forecasts as needed, respond to changes in the business environment, and stay on track towards achieving your financial goals. By doing so, you're not only keeping your business financially healthy but also setting the stage for sustained growth and success.

Business Financial Plan Example: Joe’s Coffee Shop

Now, let's look at a practical example of a financial plan for a hypothetical business, Joe’s Coffee Shop.

Sales Forecast

When constructing his sales forecast, Joe takes into account several significant factors. He reviews his historical sales data, identifies and understands current market trends, and evaluates the impact of any upcoming promotional events. With his coffee shop located in a bustling area, Joe expects to sell approximately 200 cups of coffee daily. Each cup is priced at $5, which gives him a daily sales prediction of $1000. Multiplying this figure by 365 (days in a year), his forecast for Year 1 is an annual revenue of $365,000. This projection provides Joe with a financial target to aim for and serves as a foundation for his further financial planning. It is worth noting that Joe's sales forecast may need adjustments throughout the year based on actual performance and changes in the market or business environment.

Expenses Budget

To run his coffee shop smoothly, Joe has identified several fixed and variable costs he'll need to budget for. His fixed costs, which are costs that will not change regardless of his coffee shop's sales volume, include rent, which is $2000 per month, salaries for his employees, which total $8000 per month, and utilities like electricity and water, which add up to about $500 per month.

In addition to these fixed costs, Joe also has variable costs to consider. These are costs that fluctuate depending on his sales volume and include the price of coffee beans, milk, sugar, and pastries, which he sells alongside his coffee. After a careful review of all these expenses, Joe estimates that his total annual expenses will be around $145,000. This comprehensive expense budget provides a clearer picture of how much Joe needs to earn in sales to cover his costs and achieve profitability.

Cash Flow Statement

With a clear understanding of his expected sales revenue and expenses, Joe can now proceed to develop a cash flow statement. This statement provides a comprehensive overview of all the cash inflows and outflows within his business. When Joe opened his coffee shop, he invested an initial capital of $50,000. He expects that the monthly cash inflows from sales will be about $30,417 (which is his annual revenue of $365,000 divided by 12), and his monthly cash outflows for expenses will amount to approximately $12,083 (his total annual expenses of $145,000 divided by 12). The cash flow statement gives Joe insights into his business's liquidity. It helps him track when and where his cash is coming from and where it is going. This understanding can assist him in managing his cash resources effectively and ensure he has sufficient cash to meet his business's operational needs and financial obligations.

Income Statement and Balance Sheet

With the figures from his sales forecast, expense budget, and cash flow statement, Joe can prepare his income statement and balance sheet. The income statement, or Profit & Loss (P&L) statement, reveals the profitability of Joe's coffee shop. It calculates the net profit by subtracting the total expenses from total sales revenue. In Joe's case, this means his net profit for Year 1 is expected to be $220,000 ($365,000 in revenue minus $145,000 in expenses).

The balance sheet, on the other hand, provides a snapshot of the coffee shop's financial position at a specific point in time. It includes Joe's initial capital investment of $50,000, his assets like coffee machines, furniture, and inventory, and his liabilities, which might include any loans he took to start the business and accounts payable.

The income statement and balance sheet not only reflect the financial health of Joe's coffee shop but also serve as essential tools for making informed business decisions and strategies. By continually monitoring and updating these statements, Joe can keep his finger on the pulse of his business's financial performance and make necessary adjustments to ensure sustained profitability and growth.

Best Practices in Business Financial Planning

While crafting a business financial plan, consider the following best practices:

- Realistic Projections : Ensure your forecasts are realistic, based on solid data and reasonable assumptions.

- Scenario Planning : Plan for best-case, worst-case, and most likely scenarios. This will help you prepare for different eventualities.

- Regular Reviews : Regularly review and update your plan to reflect changes in business conditions.

- Seek Professional Help : If you are unfamiliar with financial planning, consider seeking assistance from a financial consultant.

The importance of a meticulously prepared business financial plan cannot be overstated. It forms the backbone of any successful business, steering it towards a secure financial future. Creating a solid financial plan requires a blend of careful analysis, precise forecasting, clear and measurable goal setting, prudent budgeting, and efficient cash flow management. The process may seem overwhelming at first, especially for budding entrepreneurs. However, it's crucial to understand that financial planning is not an event, but rather an ongoing process. This process involves constant monitoring, evaluation, and continuous updating of the financial plan as the business grows and market conditions change.

The strategies and best practices outlined in this article offer an invaluable framework for any entrepreneur or business owner embarking on the journey of creating a financial plan. It provides insights into essential elements such as setting clear financial goals, creating a sales forecast, preparing an expense budget, developing a cash flow statement, and preparing income statements and balance sheets. Moreover, the example of Joe and his coffee shop gives a practical, real-world illustration of how these elements come together to form a coherent and effective financial plan. This example demonstrates how a robust financial plan can help manage resources more efficiently, make better-informed decisions, and ultimately lead to financial success.

Remember, every grand journey begins with a single step. In the realm of business, this step is creating a well-crafted, comprehensive, and realistic business financial plan. By following the guidelines and practices suggested in this article, you are laying the foundation for financial stability, profitability, and long-term success for your business. Start your journey today, and let the road to financial success unfold.

Related blogs

Stay up to date on the latest investment opportunities

.png)

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

How to Write the Financial Section of a Business Plan

Susan Ward wrote about small businesses for The Balance for 18 years. She has run an IT consulting firm and designed and presented courses on how to promote small businesses.

:max_bytes(150000):strip_icc():format(webp)/SusanWardLaptop2crop1-57aa62eb5f9b58974a12bac9.jpg)

Taking Stock of Expenses

The income statement, the cash flow projection, the balance sheet.

The financial section of your business plan determines whether or not your business idea is viable and will be the focus of any investors who may be attracted to your business idea. The financial section is composed of four financial statements: the income statement, the cash flow projection, the balance sheet, and the statement of shareholders' equity. It also should include a brief explanation and analysis of these four statements.

Think of your business expenses as two cost categories: your start-up expenses and your operating expenses. All the costs of getting your business up and running should be considered start-up expenses. These may include:

- Business registration fees

- Business licensing and permits

- Starting inventory

- Rent deposits

- Down payments on a property

- Down payments on equipment

- Utility setup fees

Your own list will expand as soon as you start to itemize them.

Operating expenses are the costs of keeping your business running . Think of these as your monthly expenses. Your list of operating expenses may include:

- Salaries (including your own)

- Rent or mortgage payments

- Telecommunication expenses

- Raw materials

- Distribution

- Loan payments

- Office supplies

- Maintenance

Once you have listed all of your operating expenses, the total will reflect the monthly cost of operating your business. Multiply this number by six, and you have a six-month estimate of your operating expenses. Adding this amount to your total startup expenses list, and you have a ballpark figure for your complete start-up costs.

Now you can begin to put together your financial statements for your business plan starting with the income statement.

The income statement shows your revenues, expenses, and profit for a particular period—a snapshot of your business that shows whether or not your business is profitable. Subtract expenses from your revenue to determine your profit or loss.

While established businesses normally produce an income statement each fiscal quarter or once each fiscal year, for the purposes of the business plan, an income statement should be generated monthly for the first year.

Not all of the categories in this income statement will apply to your business. Eliminate those that do not apply, and add categories where necessary to adapt this template to your business.

If you have a product-based business, the revenue section of the income statement will look different. Revenue will be called sales, and you should account for any inventory.

The cash flow projection shows how cash is expected to flow in and out of your business. It is an important tool for cash flow management because it indicates when your expenditures are too high or if you might need a short-term investment to deal with a cash flow surplus. As part of your business plan, the cash flow projection will show how much capital investment your business idea needs.

For investors, the cash flow projection shows whether your business is a good credit risk and if there is enough cash on hand to make your business a good candidate for a line of credit, a short-term loan , or a longer-term investment. You should include cash flow projections for each month over one year in the financial section of your business plan.

Do not confuse the cash flow projection with the cash flow statement. The cash flow statement shows the flow of cash in and out of your business. In other words, it describes the cash flow that has occurred in the past. The cash flow projection shows the cash that is anticipated to be generated or expended over a chosen period in the future.

There are three parts to the cash flow projection:

- Cash revenues: Enter your estimated sales figures for each month. Only enter the sales that are collectible in cash during each month you are detailing.

- Cash disbursements: Take the various expense categories from your ledger and list the cash expenditures you actually expect to pay for each month.

- Reconciliation of cash revenues to cash disbursements: This section shows an opening balance, which is the carryover from the previous month's operations. The current month's revenues are added to this balance, the current month's disbursements are subtracted, and the adjusted cash flow balance is carried over to the next month.